MPs Call For One-Year Extension To Proposed Farm Inheritance Tax

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MPs Call for One-Year Extension to Proposed Farm Inheritance Tax

Farmers across the nation are breathing a collective sigh of relief as a significant number of MPs are calling for a one-year extension to the proposed changes in farm inheritance tax. The controversial legislation, slated to come into effect on April 6th, 2024, has sparked widespread protests and anxieties within the agricultural community. This potential delay offers a crucial lifeline, giving farmers more time to adjust their financial plans and potentially avoid devastating consequences.

The proposed changes, detailed in the Agriculture and Land Reform Bill, significantly alter the existing rules surrounding the inheritance of farmland, potentially leading to substantial tax burdens for many farming families. This has raised concerns about the long-term viability of family farms, a cornerstone of the nation's agricultural landscape and rural economies.

<h3>The Core Concerns of Farmers and MPs</h3>

The main points of contention revolve around the complexities of the new tax regulations and the insufficient time given for farmers to adapt. Many MPs argue that the current timeframe is simply unrealistic, leaving farmers with little opportunity to restructure their businesses and meet the new requirements. Specifically, they highlight:

- Valuation challenges: Determining the accurate value of farmland, considering fluctuating market prices and unique land characteristics, presents a significant hurdle. The proposed legislation lacks clarity on valuation methodologies, causing further uncertainty.

- Lack of support and guidance: Farmers are calling for improved government support and clear guidelines to navigate the complex new regulations. The current system offers insufficient resources and training to help farmers understand and comply with the changes.

- Impact on family businesses: The new tax burdens threaten the long-term sustainability of family-run farms, which form the backbone of the agricultural sector. Many fear that these changes will force the sale of land, leading to fragmentation of holdings and a loss of agricultural expertise.

"This isn't just about money; it's about the future of our farming communities," stated MP Sarah Jones, a vocal supporter of the proposed extension. "We need to give farmers the time they need to plan for these changes responsibly, without fear of financial ruin."

<h3>A Necessary Delay or Political Maneuvering?</h3>

While the call for a one-year extension is welcomed by many farmers, some critics suggest this is a mere political tactic to appease growing discontent. Opponents argue that the current tax system is unfair and needs reform, regardless of the timeframe. However, even those opposed to the initial legislation acknowledge the need for a smoother transition process.

<h3>What Happens Next?</h3>

The fate of the proposed extension now rests on the government's response. A parliamentary debate is expected in the coming weeks, where the proposal will be thoroughly scrutinized. Farming organizations and industry leaders are actively lobbying MPs to support the extension, highlighting the potentially devastating consequences of a hasty implementation. The outcome will significantly impact the future of farming in the country, influencing investment decisions, land ownership, and the overall health of the agricultural sector. Stay tuned for further updates as this crucial issue unfolds.

Related articles:

Call to action: Learn more about the proposed farm inheritance tax changes and how they might affect you by visiting [link to relevant government website or farming organization].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MPs Call For One-Year Extension To Proposed Farm Inheritance Tax. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ancelotti Pelatih Timnas Brasil Casemiro Setuju

May 17, 2025

Ancelotti Pelatih Timnas Brasil Casemiro Setuju

May 17, 2025 -

Farm Inheritance Tax Changes Mps Seek 1 Year Postponement

May 17, 2025

Farm Inheritance Tax Changes Mps Seek 1 Year Postponement

May 17, 2025 -

Analisis Hukum Perbandingan Kasus Korupsi Rita Widyasari Dan Penyebaran Konten Inses

May 17, 2025

Analisis Hukum Perbandingan Kasus Korupsi Rita Widyasari Dan Penyebaran Konten Inses

May 17, 2025 -

Labours Starmer Under Pressure Albania Trip Controversy And Positive Economic News Clash

May 17, 2025

Labours Starmer Under Pressure Albania Trip Controversy And Positive Economic News Clash

May 17, 2025 -

War Crimes Defamation Ben Roberts Smiths Appeal Bid Rejected

May 17, 2025

War Crimes Defamation Ben Roberts Smiths Appeal Bid Rejected

May 17, 2025

Latest Posts

-

Implikasi Hukum Dari Kasus Rita Widyasari Dan Konten Inses Tantangan Penegakan Hukum

May 17, 2025

Implikasi Hukum Dari Kasus Rita Widyasari Dan Konten Inses Tantangan Penegakan Hukum

May 17, 2025 -

Fastest Economic Growth In Years Can Starmer Capitalize Despite Albania Controversy

May 17, 2025

Fastest Economic Growth In Years Can Starmer Capitalize Despite Albania Controversy

May 17, 2025 -

Sentra Tenun Kediri Dikelilingi Artis Film Cocote Dan Tonggo

May 17, 2025

Sentra Tenun Kediri Dikelilingi Artis Film Cocote Dan Tonggo

May 17, 2025 -

Info Terbaru Jadwal And Syarat Pendaftaran Spmb Jakarta 2025

May 17, 2025

Info Terbaru Jadwal And Syarat Pendaftaran Spmb Jakarta 2025

May 17, 2025 -

Ukraine Peace Prospects Hinge On Trump And Putins Participation Us Assessment

May 17, 2025

Ukraine Peace Prospects Hinge On Trump And Putins Participation Us Assessment

May 17, 2025 -

Depok Airgun Ketua Grib Jaya Terarah Ke Pekerja Alat Berat

May 17, 2025

Depok Airgun Ketua Grib Jaya Terarah Ke Pekerja Alat Berat

May 17, 2025 -

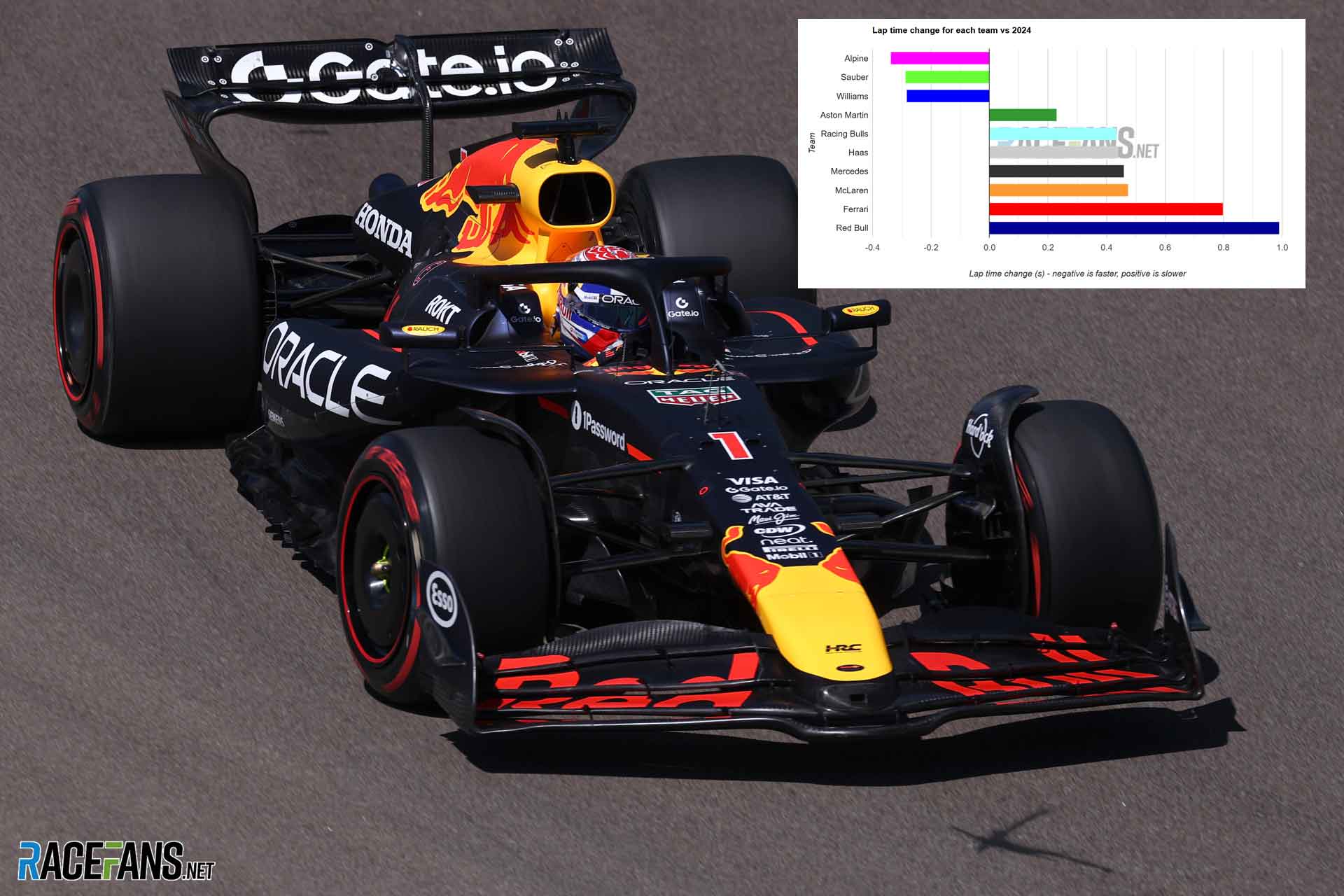

Significant Pace Deficit Red Bulls Imola Showing Underscores 2024 Challenges

May 17, 2025

Significant Pace Deficit Red Bulls Imola Showing Underscores 2024 Challenges

May 17, 2025 -

Toprak Razgatlioglu And Moto Gp Jorge Martins Transfer And Its Implications

May 17, 2025

Toprak Razgatlioglu And Moto Gp Jorge Martins Transfer And Its Implications

May 17, 2025 -

Persiapan Spmb Jakarta 2025 Jadwal Pendaftaran Seluruh Jenjang

May 17, 2025

Persiapan Spmb Jakarta 2025 Jadwal Pendaftaran Seluruh Jenjang

May 17, 2025 -

Dilema Sandy Walsh Di Yokohama F Marinos Antara Kurangnya Kesempatan Dan Performa Tim

May 17, 2025

Dilema Sandy Walsh Di Yokohama F Marinos Antara Kurangnya Kesempatan Dan Performa Tim

May 17, 2025