Farm Inheritance Tax Changes: MPs Seek 1-Year Postponement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Farm Inheritance Tax Changes: MPs Seek One-Year Postponement Amidst Rural Outcry

Farmers across the UK are breathing a collective sigh of relief as MPs launch a campaign to delay the controversial inheritance tax changes impacting agricultural land. The proposed reforms, slated to come into effect on [Insert Date], have sparked widespread protests and concerns about the future of family farms. This article delves into the details of the proposed changes, the reasons behind the calls for a postponement, and what this means for the future of farming in the UK.

The current inheritance tax system already places a significant burden on family-run farms. The proposed changes, however, threaten to exacerbate this issue, potentially forcing many to sell off land to meet the tax obligations upon the death of a family member. This could lead to a significant loss of agricultural land and a devastating blow to the rural economy.

Why the Urgent Call for a One-Year Delay?

Several key reasons are driving the MPs' push for a one-year postponement:

- Lack of Consultation: Many MPs argue that insufficient consultation took place with farmers and rural communities before the changes were announced. This lack of engagement has led to significant uncertainty and anxiety within the sector.

- Economic Uncertainty: With the ongoing cost of living crisis and increasing input costs for farmers, the additional burden of inheritance tax could prove catastrophic for many businesses. A one-year delay would allow farmers to better prepare for the changes and potentially mitigate some of the financial impact.

- Need for Realistic Valuation: The current valuation methods for agricultural land are considered by many to be outdated and fail to accurately reflect the true value of a working farm. A delay would provide time to review and potentially revise these methods.

- Protecting Family Farms: The heart of the matter lies in preserving the legacy of family farms, many of which have been passed down through generations. The proposed changes risk fragmenting these vital assets and irrevocably altering the landscape of British agriculture.

What the Proposed Changes Entail:

[Insert detailed explanation of the proposed inheritance tax changes. This should include specifics about thresholds, exemptions, and how they impact agricultural land. Use clear and concise language, avoiding jargon.] For instance, you could explain changes to Agricultural Property Relief (APR) or other relevant tax allowances.

The Fight for Fairer Taxation:

The campaign for a one-year postponement is gaining momentum, with [mention specific MPs or organizations involved]. They argue that the government needs to take a more nuanced approach, recognizing the unique challenges faced by family farms. They are calling for a thorough review of the proposed changes, including consultations with industry experts and stakeholders.

Looking Ahead:

The next few months will be crucial. The outcome of this campaign will significantly impact the future of farming in the UK. While a one-year delay is being sought, the long-term goal remains to establish a fairer and more sustainable inheritance tax system that supports the vital role of family farms in the nation's food security and rural economy.

Stay informed about the latest developments in this crucial issue by [suggest actions, e.g., subscribing to newsletters, following relevant organizations on social media, etc.]. The fight for the future of family farms is far from over.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Farm Inheritance Tax Changes: MPs Seek 1-Year Postponement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mantan Kades Sitinjo Ii Ditangkap Diduga Korupsi Dana Desa 2023

May 17, 2025

Mantan Kades Sitinjo Ii Ditangkap Diduga Korupsi Dana Desa 2023

May 17, 2025 -

Konfirmasi Resmi Sandy Walsh Masuk Starting Xi Yokohama Setelah 7 Pertandingan

May 17, 2025

Konfirmasi Resmi Sandy Walsh Masuk Starting Xi Yokohama Setelah 7 Pertandingan

May 17, 2025 -

Persiapan Uji Coba Spmb Smp Surabaya Tips And Trik Sukses 26 Mei

May 17, 2025

Persiapan Uji Coba Spmb Smp Surabaya Tips And Trik Sukses 26 Mei

May 17, 2025 -

Jadwal Pendaftaran Spmb Jakarta 2025 Sd Smp Sma And Smk

May 17, 2025

Jadwal Pendaftaran Spmb Jakarta 2025 Sd Smp Sma And Smk

May 17, 2025 -

Updated Assisted Dying Legislation Debate Looms In Uk Parliament

May 17, 2025

Updated Assisted Dying Legislation Debate Looms In Uk Parliament

May 17, 2025

Latest Posts

-

Konten Inses Dan Korupsi Rita Widyasari Implikasi Hukum Dan Tantangan Penegakannya

May 17, 2025

Konten Inses Dan Korupsi Rita Widyasari Implikasi Hukum Dan Tantangan Penegakannya

May 17, 2025 -

One In Ten Britons Lack Savings A Uk Financial Regulator Report

May 17, 2025

One In Ten Britons Lack Savings A Uk Financial Regulator Report

May 17, 2025 -

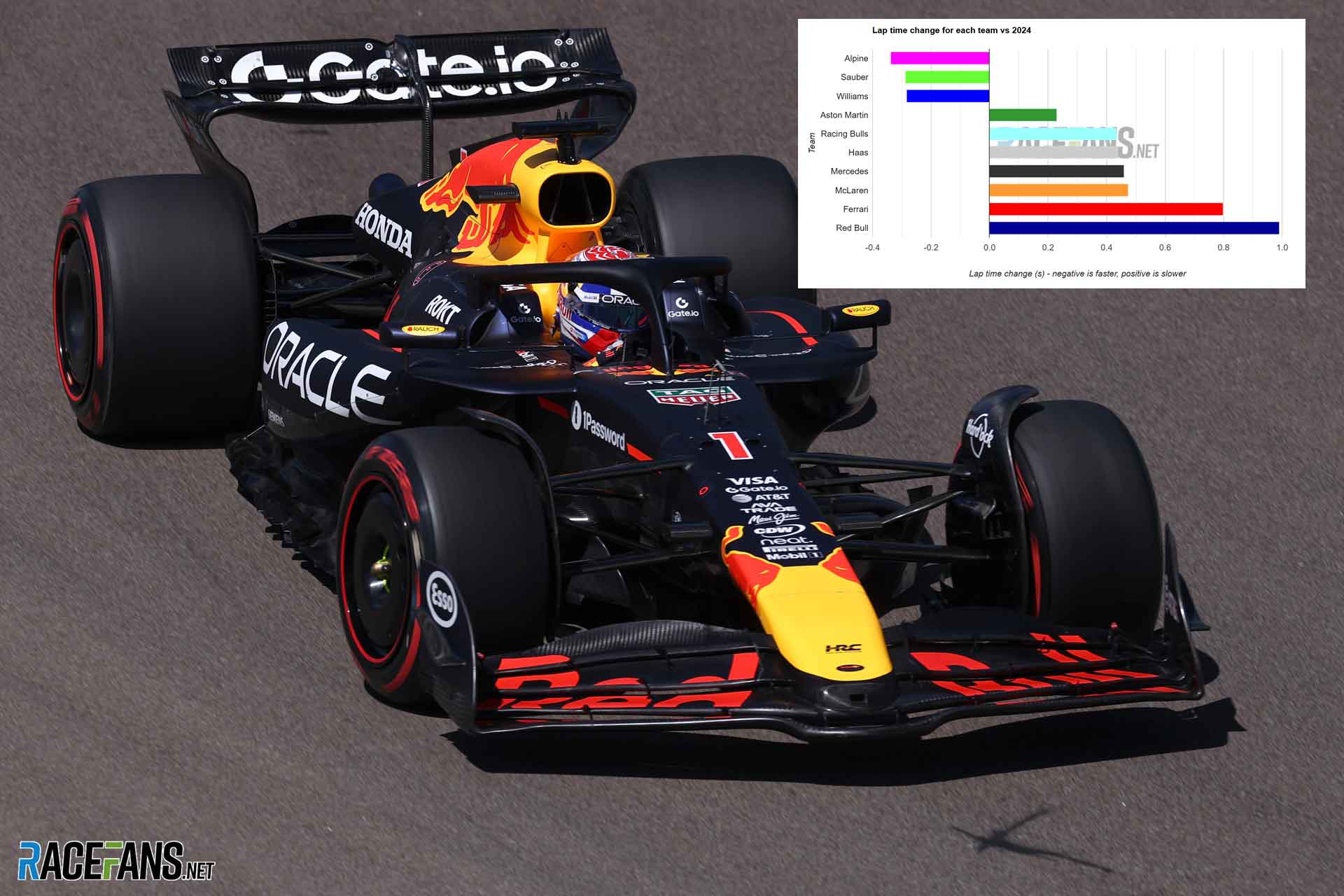

Red Bulls Speed Concerns Verstappens Tough Imola Day

May 17, 2025

Red Bulls Speed Concerns Verstappens Tough Imola Day

May 17, 2025 -

Depok Airgun Mengarah Ke Pekerja Kronologi Penembakan Oleh Ketua Grib Jaya

May 17, 2025

Depok Airgun Mengarah Ke Pekerja Kronologi Penembakan Oleh Ketua Grib Jaya

May 17, 2025 -

Ukraine To Participate In Peace Talks Amidst Us Call For Trump Putin Engagement

May 17, 2025

Ukraine To Participate In Peace Talks Amidst Us Call For Trump Putin Engagement

May 17, 2025 -

Analysis Red Bull Lags Behind 2024 Targets After Imola

May 17, 2025

Analysis Red Bull Lags Behind 2024 Targets After Imola

May 17, 2025 -

Police Charge Suspect In Arson Attacks Near Keir Starmers Residence

May 17, 2025

Police Charge Suspect In Arson Attacks Near Keir Starmers Residence

May 17, 2025 -

Police Charge Chris Brown In Connection With London Nightclub Attack

May 17, 2025

Police Charge Chris Brown In Connection With London Nightclub Attack

May 17, 2025 -

Kunjungan Cak Imin Ke Vatikan Atas Permintaan Prabowo

May 17, 2025

Kunjungan Cak Imin Ke Vatikan Atas Permintaan Prabowo

May 17, 2025 -

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Di Zona Degradasi

May 17, 2025

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Di Zona Degradasi

May 17, 2025