Year-Long Delay Urged For New Farm Inheritance Tax Rules

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Year-Long Delay Urged for New Farm Inheritance Tax Rules: Farmers Demand Reprieve

Farmers across the nation are calling for a one-year delay in the implementation of the new inheritance tax rules affecting agricultural land. The proposed changes, slated to take effect on [Insert Date], have sparked widespread concern and protests, with farmers arguing the legislation is poorly timed and will devastate rural communities. The outcry has led to calls for a comprehensive review and a much-needed postponement.

The new rules, designed to [briefly and neutrally explain the stated aim of the new rules, e.g., "modernize the taxation of inherited farmland and close loopholes"], are perceived by many farmers as overly complex and potentially crippling to family farms that have been passed down through generations. Critics argue the regulations fail to adequately consider the unique challenges faced by agricultural businesses, including fluctuating commodity prices and the significant capital investment required for land management and equipment.

Concerns Raised by Farming Communities

The primary concerns center around several key areas:

- Valuation complexities: Farmers worry about the accuracy and fairness of land valuations, which form the basis of the inheritance tax calculations. Inconsistent valuation methods could lead to unfair tax burdens and financial hardship.

- Lack of transitional support: The absence of adequate support mechanisms for farmers adapting to the new rules is a significant point of contention. Many fear the sudden implementation will force the sale of family farms to cover tax liabilities.

- Impact on rural economies: The potential loss of family farms could have a devastating impact on rural economies, leading to job losses and a decline in local agricultural production. This ripple effect could extend to related businesses and services.

“These new rules are a hammer blow to family farms,” stated [Quote from a prominent farmer or farming organization representative]. “We're not asking for special treatment, just a reasonable delay to allow for a proper assessment and the development of a more sustainable and equitable system.”

Calls for a One-Year Delay Gain Momentum

The demand for a one-year delay is gaining significant traction, with numerous farming organizations and political figures voicing their support. A petition calling for the postponement has already garnered [Number] signatures, highlighting the widespread dissatisfaction with the proposed changes. [Link to petition if available].

Several leading agricultural economists have also weighed in, suggesting that a delay would allow for a more thorough analysis of the potential economic consequences and the development of mitigation strategies to minimize the impact on family farms.

[Optional: Add a short paragraph about any government response to the concerns so far. If there is no response yet, mention that the government is yet to comment.]

What Happens Next?

The coming weeks will be crucial in determining the future of these contentious inheritance tax rules. The pressure on the government to respond to the farmers' concerns is mounting. Whether they will concede to a one-year delay or opt for a more comprehensive review remains to be seen. This situation will undoubtedly continue to dominate headlines and shape the agricultural landscape for the foreseeable future. Stay tuned for further updates.

Keywords: Farm inheritance tax, agricultural land tax, inheritance tax reform, rural economy, family farms, farming crisis, tax delay, government policy, agricultural policy, land valuation, farming communities, petition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Year-Long Delay Urged For New Farm Inheritance Tax Rules. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nikola Jokics Three Point Shooting Evolution And Current Dominance

May 17, 2025

Nikola Jokics Three Point Shooting Evolution And Current Dominance

May 17, 2025 -

Mps Call For Farm Inheritance Tax Proposal Freeze A Years Extension Requested

May 17, 2025

Mps Call For Farm Inheritance Tax Proposal Freeze A Years Extension Requested

May 17, 2025 -

Drama Moto Gp 13 Pembalap Ini Putus Kontrak Mendadak Siapa Saja

May 17, 2025

Drama Moto Gp 13 Pembalap Ini Putus Kontrak Mendadak Siapa Saja

May 17, 2025 -

Age And Chat Gpt Understanding Usage Patterns

May 17, 2025

Age And Chat Gpt Understanding Usage Patterns

May 17, 2025 -

No Putin Kremlins Ukraine Peace Talks Team Revealed For Turkey Summit

May 17, 2025

No Putin Kremlins Ukraine Peace Talks Team Revealed For Turkey Summit

May 17, 2025

Latest Posts

-

Konten Inses Dan Korupsi Rita Widyasari Implikasi Hukum Dan Tantangan Penegakannya

May 17, 2025

Konten Inses Dan Korupsi Rita Widyasari Implikasi Hukum Dan Tantangan Penegakannya

May 17, 2025 -

One In Ten Britons Lack Savings A Uk Financial Regulator Report

May 17, 2025

One In Ten Britons Lack Savings A Uk Financial Regulator Report

May 17, 2025 -

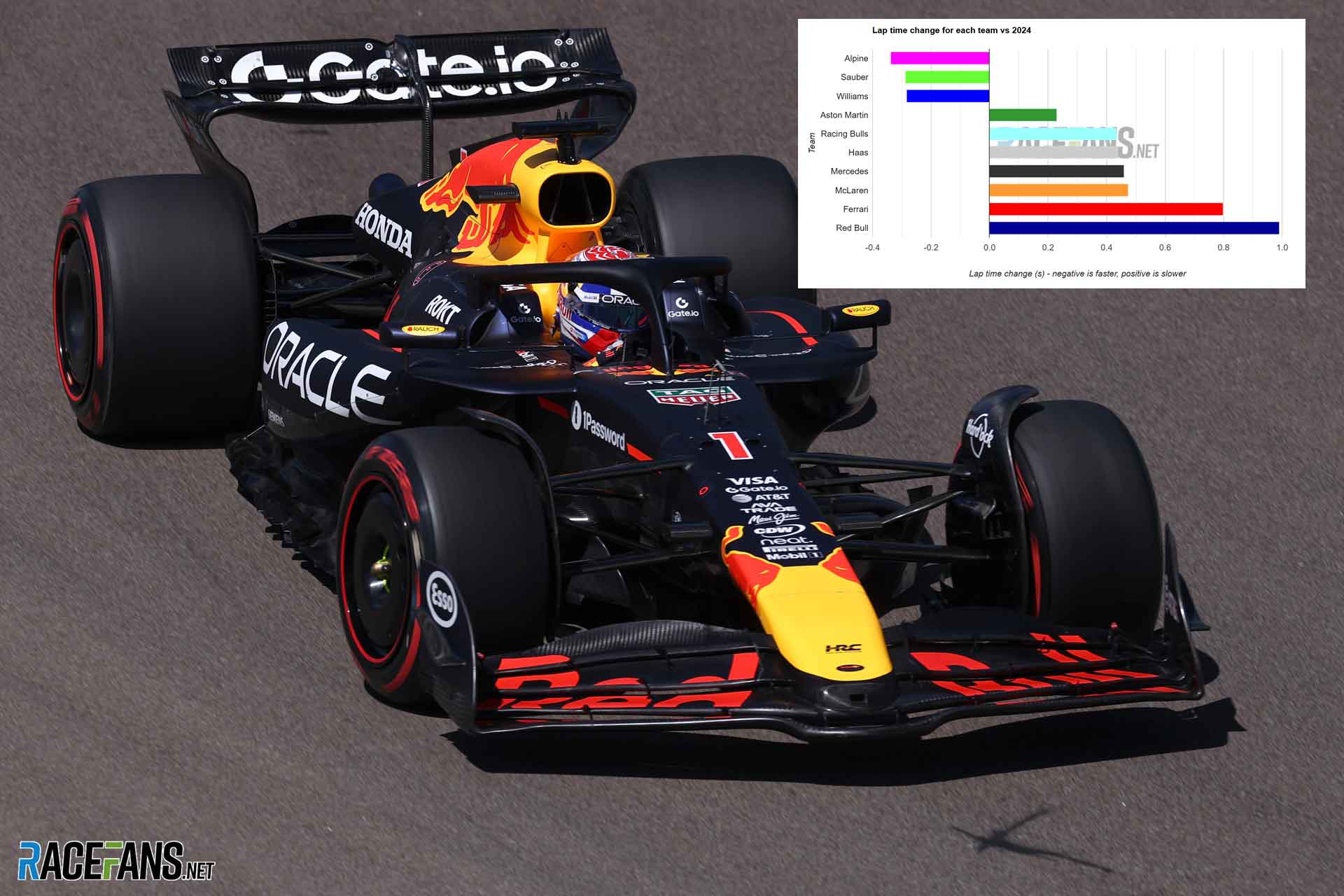

Red Bulls Speed Concerns Verstappens Tough Imola Day

May 17, 2025

Red Bulls Speed Concerns Verstappens Tough Imola Day

May 17, 2025 -

Depok Airgun Mengarah Ke Pekerja Kronologi Penembakan Oleh Ketua Grib Jaya

May 17, 2025

Depok Airgun Mengarah Ke Pekerja Kronologi Penembakan Oleh Ketua Grib Jaya

May 17, 2025 -

Ukraine To Participate In Peace Talks Amidst Us Call For Trump Putin Engagement

May 17, 2025

Ukraine To Participate In Peace Talks Amidst Us Call For Trump Putin Engagement

May 17, 2025 -

Analysis Red Bull Lags Behind 2024 Targets After Imola

May 17, 2025

Analysis Red Bull Lags Behind 2024 Targets After Imola

May 17, 2025 -

Police Charge Suspect In Arson Attacks Near Keir Starmers Residence

May 17, 2025

Police Charge Suspect In Arson Attacks Near Keir Starmers Residence

May 17, 2025 -

Police Charge Chris Brown In Connection With London Nightclub Attack

May 17, 2025

Police Charge Chris Brown In Connection With London Nightclub Attack

May 17, 2025 -

Kunjungan Cak Imin Ke Vatikan Atas Permintaan Prabowo

May 17, 2025

Kunjungan Cak Imin Ke Vatikan Atas Permintaan Prabowo

May 17, 2025 -

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Di Zona Degradasi

May 17, 2025

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Di Zona Degradasi

May 17, 2025