UK Tax Rises: Five Potential Pathways To Higher Taxation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Tax Rises: Five Potential Pathways to Higher Taxation

The UK government faces a looming fiscal challenge, with rising inflation and public spending demands creating a significant budget deficit. This has led to widespread speculation about potential tax rises in the coming years. While the exact measures remain uncertain, several pathways to increased taxation are being debated, each with significant implications for individuals and businesses. This article explores five potential avenues for higher taxation in the UK.

1. Income Tax Increases: A classic method for boosting government revenue, increasing income tax is a straightforward option. This could involve raising the basic rate, increasing the higher or additional rate thresholds, or even introducing new higher bands. Higher earners would likely bear the brunt of such a change, although any increase to the basic rate would affect a far wider section of the population. The impact on consumer spending and economic growth would be a key consideration for the government.

2. Corporation Tax Hikes: Businesses could also face increased contributions to the national coffers through higher corporation tax. The current rate is already planned to increase to 25%, but further rises are not ruled out. A higher corporation tax could deter investment and hinder economic growth, potentially impacting job creation and competitiveness. The government would need to carefully balance the need for increased revenue with the potential negative consequences for the business environment.

3. National Insurance Contributions (NICs): This indirect tax on earnings could be increased, impacting both employees and employers. A rise in NICs could disproportionately affect lower-income earners, particularly those already struggling with the cost of living crisis. The potential for increased social security benefits to offset the impact on low earners would likely be debated heavily. Changes to NICs could also be targeted towards specific sectors or income levels.

4. Expansion of VAT: Value Added Tax, a consumption tax, could be broadened to include more goods and services currently exempt. This is a politically sensitive area, as it can impact the cost of essential items and disproportionately affect lower-income households. Extending VAT to currently exempt goods like food or children's clothing would be highly controversial. The government would need to consider the potential inflationary impact of such a move.

5. Wealth Taxes: This increasingly discussed option involves taxing the assets of high-net-worth individuals, potentially including property, investments, and other forms of wealth. Implementing a wealth tax presents significant practical challenges, including valuation difficulties and the potential for capital flight. This option has received renewed attention recently as a way to address wealth inequality, but its complexities make it a less straightforward solution than other options.

The Road Ahead: The specific path or combination of paths the government ultimately chooses will depend on a complex interplay of economic factors, political considerations, and public opinion. The upcoming budget announcements will be closely watched for any clues about the government’s taxation strategy. Understanding these potential pathways is crucial for individuals and businesses to plan for the future and adapt to potential changes in the tax landscape. For detailed analysis and up-to-date information, consult resources like the and . Stay informed to navigate the evolving tax environment effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Tax Rises: Five Potential Pathways To Higher Taxation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Update Terbaru Acara Jumpa Penggemar Kim Soo Hyun Di Taiwan Resmi Dibatalkan

Mar 28, 2025

Update Terbaru Acara Jumpa Penggemar Kim Soo Hyun Di Taiwan Resmi Dibatalkan

Mar 28, 2025 -

Could Uk Taxes Rise Examining Five Potential Scenarios

Mar 28, 2025

Could Uk Taxes Rise Examining Five Potential Scenarios

Mar 28, 2025 -

Investigation Underway Newborns Death Outside Church Prompts Appeal

Mar 28, 2025

Investigation Underway Newborns Death Outside Church Prompts Appeal

Mar 28, 2025 -

Post Cancer Lauren Laverne Embraces A Life Of Fearlessness And Resilience

Mar 28, 2025

Post Cancer Lauren Laverne Embraces A Life Of Fearlessness And Resilience

Mar 28, 2025 -

Russia Demands End To Sanctions For Black Sea Grain Deal

Mar 28, 2025

Russia Demands End To Sanctions For Black Sea Grain Deal

Mar 28, 2025

Latest Posts

-

Neymars Brazil Injury Santos Provides Crucial Update On Recovery

Apr 01, 2025

Neymars Brazil Injury Santos Provides Crucial Update On Recovery

Apr 01, 2025 -

Two Tier Justice System Government Intervention On Sentencing Rules

Apr 01, 2025

Two Tier Justice System Government Intervention On Sentencing Rules

Apr 01, 2025 -

Bangkok Tower Collapse Thai Official Raises Concerns About Suspicious Activity

Apr 01, 2025

Bangkok Tower Collapse Thai Official Raises Concerns About Suspicious Activity

Apr 01, 2025 -

Jadwal Imsakiyah And Salat Lampung Hari Ini Minggu 30 Maret 2025

Apr 01, 2025

Jadwal Imsakiyah And Salat Lampung Hari Ini Minggu 30 Maret 2025

Apr 01, 2025 -

V Rising Update Prepare For The Biggest Combat Changes Yet

Apr 01, 2025

V Rising Update Prepare For The Biggest Combat Changes Yet

Apr 01, 2025 -

Morrisons And Sainsburys Cafe Closures Financial Pressures And Shifting Consumer Trends

Apr 01, 2025

Morrisons And Sainsburys Cafe Closures Financial Pressures And Shifting Consumer Trends

Apr 01, 2025 -

Thai Official Expresses Doubts About Earthquake As Sole Cause Of Bangkok Tower Collapse

Apr 01, 2025

Thai Official Expresses Doubts About Earthquake As Sole Cause Of Bangkok Tower Collapse

Apr 01, 2025 -

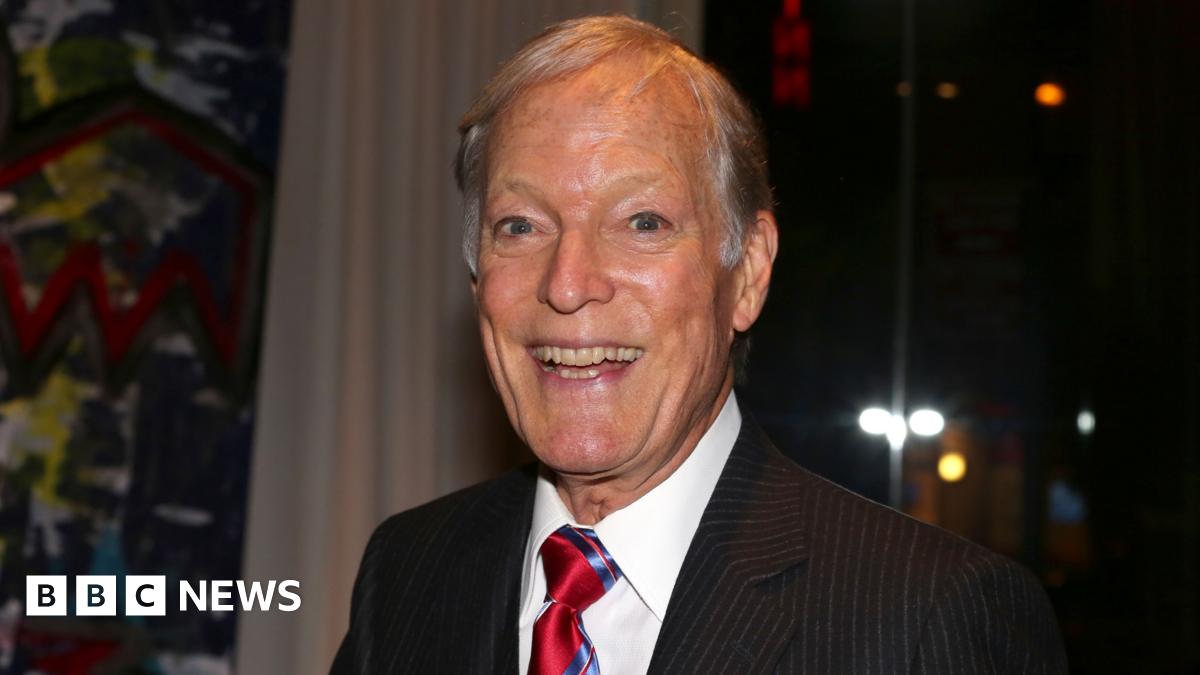

Hollywood Legend Richard Chamberlain Dead At 90 A Career Retrospective

Apr 01, 2025

Hollywood Legend Richard Chamberlain Dead At 90 A Career Retrospective

Apr 01, 2025 -

Marine Le Pen Faces Crucial Court Decision Implications For French Presidency

Apr 01, 2025

Marine Le Pen Faces Crucial Court Decision Implications For French Presidency

Apr 01, 2025 -

Lebaran 2024 Keluarga Tahanan Kpk Berharap Pertemuan Di Hari Raya

Apr 01, 2025

Lebaran 2024 Keluarga Tahanan Kpk Berharap Pertemuan Di Hari Raya

Apr 01, 2025