UK Interest Rates: A Slow Descent, Says Bank Of England

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rates: A Slow Descent, Says Bank of England – But Relief Might Be a While Coming

The Bank of England (BoE) has signaled a cautious approach to lowering interest rates, suggesting a gradual decline rather than a swift reduction. This news comes as a mixed bag for homeowners and businesses struggling with the high cost of borrowing, sparking debate about the timing and pace of future monetary policy adjustments. While a rate cut is anticipated, the BoE's measured tone indicates a protracted process, leaving many wondering when they can expect genuine relief.

A Cautious Approach to Cooling Inflation:

The BoE's recent announcement underscores its commitment to tackling inflation, albeit at a slower pace than some market analysts predicted. Persistent inflationary pressures, coupled with concerns about lingering economic uncertainty, are driving the central bank's cautious stance. While inflation is showing signs of easing, it remains significantly above the BoE's 2% target. This necessitates a careful approach to interest rate adjustments to avoid triggering renewed inflationary spikes or destabilizing the already fragile economic recovery.

What Factors are Influencing the BoE's Decision?

Several key factors are influencing the BoE's decision-making process:

- Inflation Persistence: Despite recent declines, inflation remains stubbornly high, fuelled by factors such as energy prices and supply chain disruptions.

- Wage Growth: Strong wage growth, while positive for workers, also contributes to inflationary pressures, necessitating a balanced approach to monetary policy.

- Economic Growth: The UK economy is showing signs of resilience but remains vulnerable to global economic headwinds and potential shocks. The BoE needs to assess the impact of interest rate changes on economic growth carefully.

- Global Economic Uncertainty: Geopolitical instability and global economic uncertainty add another layer of complexity to the BoE's decision-making, requiring a more cautious and data-driven approach.

The Implications for Borrowers and Businesses:

The prospect of a slow descent in interest rates offers limited immediate relief to households and businesses grappling with high borrowing costs. Mortgage payments and business loans remain significantly expensive, potentially hindering investment and consumer spending. However, the BoE's cautious approach aims to prevent a sudden surge in inflation, which could ultimately prove more damaging in the long run.

Looking Ahead: When Can We Expect Lower Rates?

Predicting the precise timing of interest rate cuts is challenging, even for experts. The BoE's forward guidance emphasizes a data-dependent approach, meaning future decisions will hinge on the incoming economic data. While a gradual reduction is expected, the pace and extent of the cuts will depend on the evolution of inflation, wage growth, and the overall economic outlook. Analysts suggest that any significant rate reductions are unlikely in the immediate future, potentially extending the period of elevated borrowing costs for several months.

Further Resources:

For more detailed information on the Bank of England's monetary policy, you can visit their official website: [Insert Link to Bank of England Website Here]

Conclusion:

The Bank of England's announcement of a slow descent in interest rates reflects a measured approach to managing inflation and supporting economic stability. While this news might disappoint those hoping for rapid relief from high borrowing costs, it underscores the complexities involved in navigating the current economic climate. The focus remains on a balanced and sustainable path to lower inflation, even if it means a longer wait for lower interest rates. Stay informed by regularly checking reputable financial news sources for updates on the evolving economic situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rates: A Slow Descent, Says Bank Of England. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Super Eagles Player Ready For Rwanda Match Supported By His Rwandan Fiancee

Mar 21, 2025

Super Eagles Player Ready For Rwanda Match Supported By His Rwandan Fiancee

Mar 21, 2025 -

Gwyneth Paltrows On Set Interaction With Intimacy Coordinator

Mar 21, 2025

Gwyneth Paltrows On Set Interaction With Intimacy Coordinator

Mar 21, 2025 -

Expert Rosenberg Trump Putin Conversation Interpreted As Russian Win

Mar 21, 2025

Expert Rosenberg Trump Putin Conversation Interpreted As Russian Win

Mar 21, 2025 -

Security Concerns Dominate In Camera Meeting As Opposition Walks Out

Mar 21, 2025

Security Concerns Dominate In Camera Meeting As Opposition Walks Out

Mar 21, 2025 -

Unity Amidst Crisis Pakistans Response To A Recent Spike In Militant Violence

Mar 21, 2025

Unity Amidst Crisis Pakistans Response To A Recent Spike In Militant Violence

Mar 21, 2025

Latest Posts

-

Xatars Beefs Diese Rapper Hatten Aerger Mit Ihm

May 10, 2025

Xatars Beefs Diese Rapper Hatten Aerger Mit Ihm

May 10, 2025 -

Link Dan Cara Cek Status Penerima Bansos Pkh 2025 Dengan Nik Ktp

May 10, 2025

Link Dan Cara Cek Status Penerima Bansos Pkh 2025 Dengan Nik Ktp

May 10, 2025 -

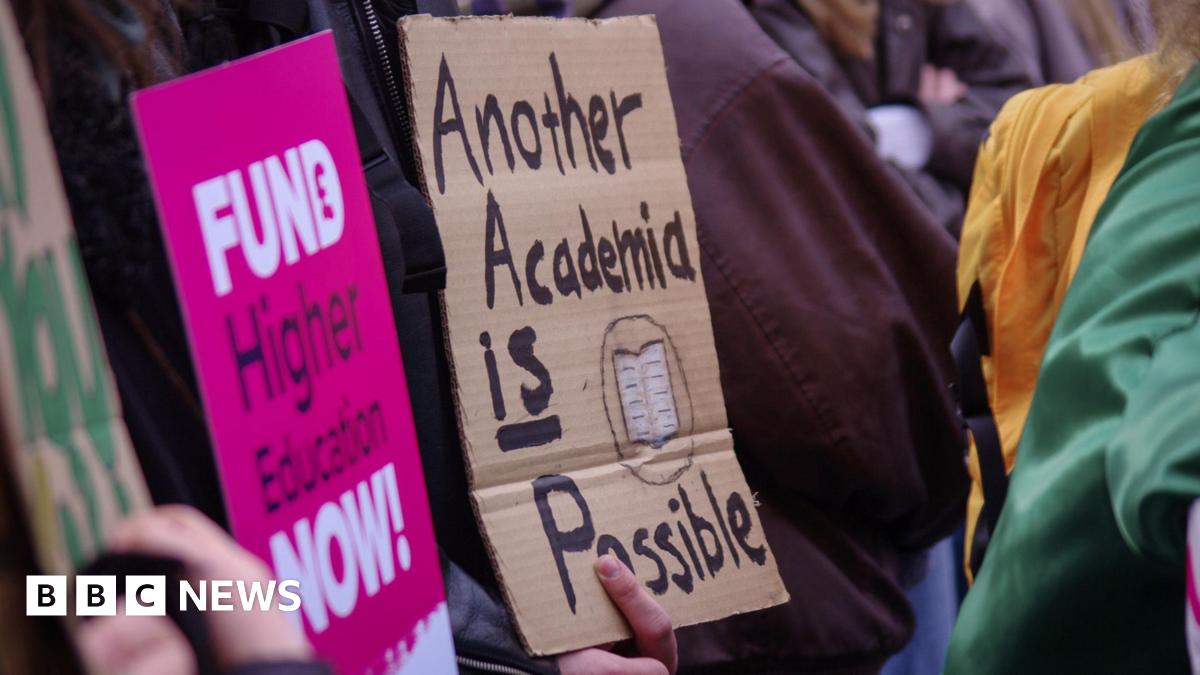

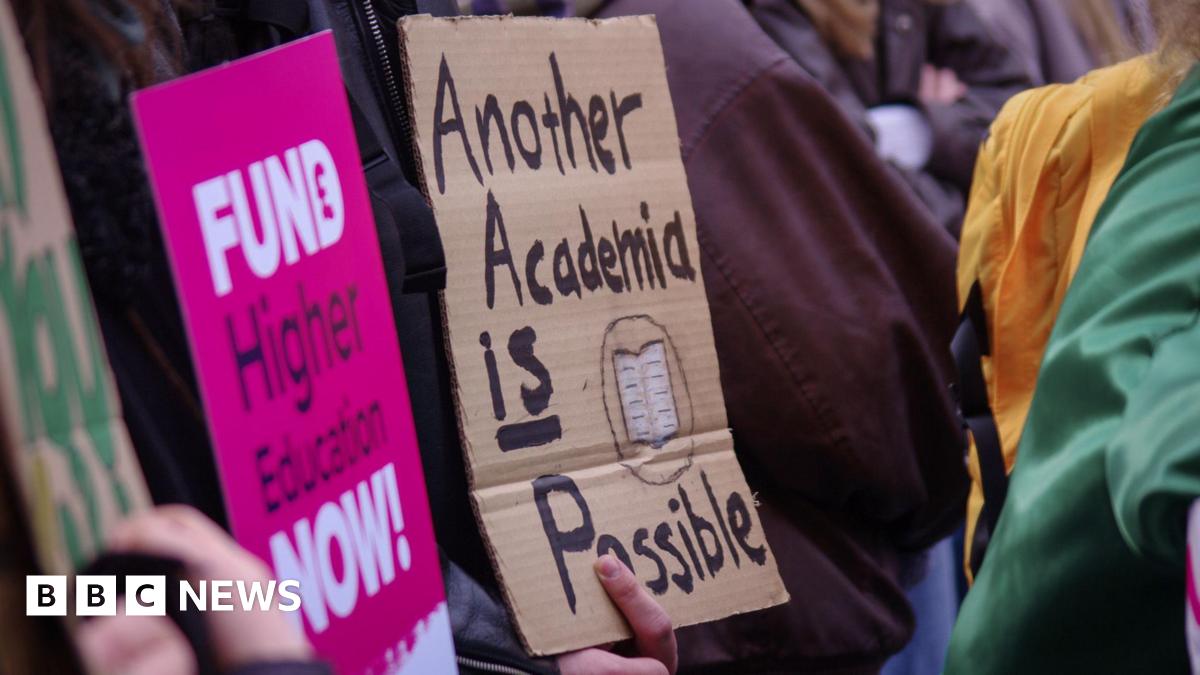

Financial Crisis Looms Four In Ten Universities Struggle

May 10, 2025

Financial Crisis Looms Four In Ten Universities Struggle

May 10, 2025 -

Peluang Terbuka Lebar Persebaya Incar Kemenangan Atas Semen Padang

May 10, 2025

Peluang Terbuka Lebar Persebaya Incar Kemenangan Atas Semen Padang

May 10, 2025 -

Gordons Testimony Challenges Martens Parenting Claims

May 10, 2025

Gordons Testimony Challenges Martens Parenting Claims

May 10, 2025 -

Raih Dua Gelar Sekaligus Persib Juara Liga 1 And Kantongi Lisensi Afc

May 10, 2025

Raih Dua Gelar Sekaligus Persib Juara Liga 1 And Kantongi Lisensi Afc

May 10, 2025 -

Menteri Zulhas Koperasi Desa Kopdes Solusi Atasi Tengkulak Dan Rentenir

May 10, 2025

Menteri Zulhas Koperasi Desa Kopdes Solusi Atasi Tengkulak Dan Rentenir

May 10, 2025 -

Lebih Dari Juara Liga 1 Persib Raih Lisensi Afc Tanpa Catatan Negatif

May 10, 2025

Lebih Dari Juara Liga 1 Persib Raih Lisensi Afc Tanpa Catatan Negatif

May 10, 2025 -

Andreevas Victory Secures Spot In Italian Open Third Round

May 10, 2025

Andreevas Victory Secures Spot In Italian Open Third Round

May 10, 2025 -

Four Out Of Ten Universities Face Severe Financial Challenges

May 10, 2025

Four Out Of Ten Universities Face Severe Financial Challenges

May 10, 2025