Trump's Comments And China Trade Deal Prospects Drive Gold Prices Lower, Dollar Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Comments and China Trade Deal Prospects Drive Gold Prices Lower, Dollar Higher

President Trump's optimistic pronouncements regarding a potential trade deal with China sent shockwaves through global markets on Tuesday, pushing gold prices down and boosting the US dollar. The precious metal, often seen as a safe haven asset, experienced its sharpest single-day decline in weeks, while the dollar strengthened against other major currencies. This unexpected market shift highlights the complex interplay between geopolitical events, investor sentiment, and the performance of key financial instruments like gold and the US dollar.

This article will delve into the specifics of Trump's comments, analyze their impact on market expectations for a US-China trade agreement, and explore the resulting consequences for gold and the dollar. We'll also look ahead to what this might mean for investors in the coming weeks.

Trump's Positive Outlook Fuels Market Optimism

President Trump's recent statements, suggesting a potential breakthrough in trade negotiations with China, injected a dose of optimism into the market. While details remained scarce, the overall tone shifted from the tense stand-off of recent months towards a more conciliatory approach. This positive sentiment overshadowed concerns about slowing global growth and other geopolitical uncertainties, triggering a risk-on attitude among investors.

- Reduced Safe-Haven Demand: This shift in sentiment directly impacted gold prices. As investor confidence increased, the demand for gold as a safe haven asset decreased. Traditionally, during times of economic uncertainty or geopolitical instability, investors flock to gold as a store of value. However, Trump's comments lessened these fears, at least temporarily.

- Dollar Strengthens on Trade Deal Hopes: The increased optimism surrounding a trade deal also boosted the US dollar. A stronger dollar generally makes gold more expensive for buyers using other currencies, further contributing to the decline in gold prices. This dynamic underscores the close correlation between the dollar's strength and gold's performance.

Analyzing the Impact on Gold and the Dollar

The immediate impact was a noticeable drop in gold prices, with spot gold falling by [Insert Percentage]% to $[Insert Price] per ounce. This marked the [Insert Day of Week]'s largest single-day price drop in [Insert Number] weeks. Conversely, the US dollar index, which measures the dollar's value against a basket of other currencies, rose by [Insert Percentage]%, reflecting the increased investor confidence and demand for the dollar.

Experts remain divided on the long-term implications. While some analysts believe that a successful trade deal could lead to sustained economic growth, potentially pushing gold prices higher in the long run, others caution against premature optimism. The path to a final agreement remains uncertain, and unforeseen setbacks could easily reverse the current market trend.

What's Next for Investors?

The volatility of the gold and dollar markets highlights the need for careful consideration by investors. The situation remains fluid, and any significant developments in US-China trade negotiations could trigger further price swings.

Investors should:

- Monitor trade negotiations closely: Stay informed about the progress of the US-China trade talks.

- Diversify portfolios: Maintain a diversified investment strategy to mitigate risk.

- Consult financial advisors: Seek professional advice before making significant investment decisions.

The current market reaction underscores the significant influence of political developments on financial markets. The interplay between geopolitical events, investor sentiment, and the performance of key assets like gold and the US dollar remains a crucial factor for investors to consider in their investment strategies. Only time will tell if Trump's optimistic outlook translates into a lasting resolution to the US-China trade dispute and what that ultimately means for gold and the dollar.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Comments And China Trade Deal Prospects Drive Gold Prices Lower, Dollar Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Stance Shifts Xau Usd Plunges Gold Suffers 200 Loss

Apr 23, 2025

Trumps Stance Shifts Xau Usd Plunges Gold Suffers 200 Loss

Apr 23, 2025 -

Flag Display Sparks Safety Fears In Lisburn Community

Apr 23, 2025

Flag Display Sparks Safety Fears In Lisburn Community

Apr 23, 2025 -

Alex Rodriguezs Heated Reaction Edwards Sinks Le Bron And Lakers In Game 2

Apr 23, 2025

Alex Rodriguezs Heated Reaction Edwards Sinks Le Bron And Lakers In Game 2

Apr 23, 2025 -

Cardinal Kevin Farrell His Role And Influence At The Vatican

Apr 23, 2025

Cardinal Kevin Farrell His Role And Influence At The Vatican

Apr 23, 2025 -

Kontras Dengan Klub Lain Semen Padang Pastikan Gaji Pemain Terbayar

Apr 23, 2025

Kontras Dengan Klub Lain Semen Padang Pastikan Gaji Pemain Terbayar

Apr 23, 2025

Latest Posts

-

Wawancara Eksklusif Ian Wilson Ungkap Fakta Di Balik Hercules Dan Grib

May 18, 2025

Wawancara Eksklusif Ian Wilson Ungkap Fakta Di Balik Hercules Dan Grib

May 18, 2025 -

I Was On The Flight Says Passenger British Airways Says Otherwise

May 18, 2025

I Was On The Flight Says Passenger British Airways Says Otherwise

May 18, 2025 -

Premier League Preview Everton Vs Southampton Team News And Prediction

May 18, 2025

Premier League Preview Everton Vs Southampton Team News And Prediction

May 18, 2025 -

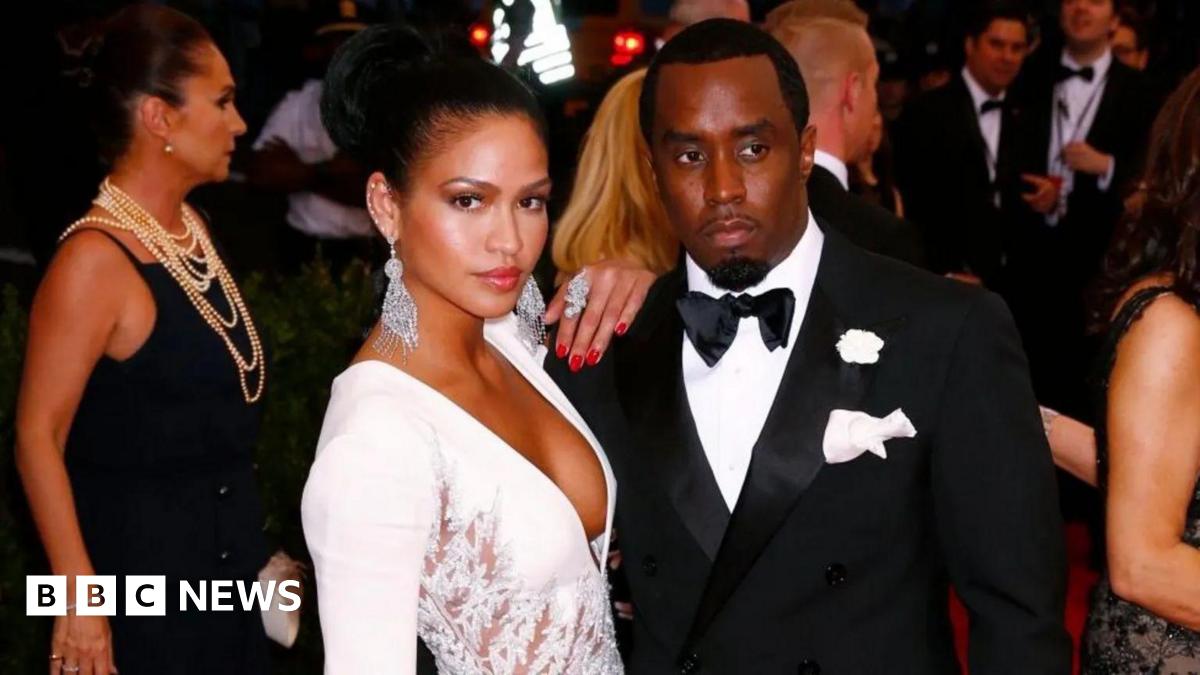

Sean Combs Legal Battle Ex Girlfriend Cassies Crucial Role

May 18, 2025

Sean Combs Legal Battle Ex Girlfriend Cassies Crucial Role

May 18, 2025 -

Target Kemenangan Psbs Biak Vs Arema Fc Duel Sengit Di Stadion

May 18, 2025

Target Kemenangan Psbs Biak Vs Arema Fc Duel Sengit Di Stadion

May 18, 2025 -

Trumps Seashell Post James Comeys Interview With The Secret Service Explained

May 18, 2025

Trumps Seashell Post James Comeys Interview With The Secret Service Explained

May 18, 2025 -

Live Streaming World Ssp Race 1 World Sbk Czech Round 2025

May 18, 2025

Live Streaming World Ssp Race 1 World Sbk Czech Round 2025

May 18, 2025 -

Did Trumps Peace Efforts Reveal His True Intentions A Behind The Scenes Look

May 18, 2025

Did Trumps Peace Efforts Reveal His True Intentions A Behind The Scenes Look

May 18, 2025 -

Matchday Preview Evertons Clash Against Southampton Lineups And Prediction

May 18, 2025

Matchday Preview Evertons Clash Against Southampton Lineups And Prediction

May 18, 2025 -

Film Dendam Kelam Malam Marissa Anita Dan Pengaruh Robert Greene

May 18, 2025

Film Dendam Kelam Malam Marissa Anita Dan Pengaruh Robert Greene

May 18, 2025