The Deliveroo Exit: A Warning Sign For UK Business Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Deliveroo Exit: A Warning Sign for UK Business Investment?

The tumultuous journey of Deliveroo, culminating in its recent exit from the London Stock Exchange, has sent shockwaves through the UK business landscape. More than just a single company's struggles, many analysts are interpreting this event as a significant warning sign for future investment in the UK. This raises serious questions about the attractiveness of the British market for both domestic and international investors.

The Deliveroo Debacle: A Recap

Deliveroo's initial public offering (IPO) in March 2021 was widely anticipated, but ultimately proved disastrous. The share price plummeted, failing to meet expectations and leaving investors significantly out of pocket. This dramatic fall can be attributed to a confluence of factors, including intense competition, a challenging regulatory environment, and perhaps most importantly, a perceived overvaluation at the time of its IPO. The company's subsequent struggles to achieve profitability ultimately led to its delisting, highlighting the risks inherent in investing in high-growth, loss-making tech companies.

Beyond Deliveroo: A Broader Concern for UK Investment

The Deliveroo case isn't an isolated incident. It reflects a broader trend of challenges facing UK businesses, particularly those in the tech sector. These include:

- Brexit Uncertainty: The ongoing economic consequences of Brexit continue to create uncertainty for businesses, impacting investment decisions and hindering growth. The added complexities of trade and regulations have made the UK a less attractive proposition for some.

- Inflation and Rising Interest Rates: The current inflationary environment and the Bank of England's response through rising interest rates are making borrowing more expensive, impacting businesses' ability to invest and expand.

- Global Economic Slowdown: The global economic slowdown is impacting investor confidence worldwide, making investors more risk-averse and less likely to invest in potentially volatile markets.

- Skills Shortages: The UK faces significant skills shortages across various sectors, making it difficult for businesses to find and retain the talent they need to grow. This is particularly acute in the tech sector.

What Does This Mean for the Future of UK Investment?

The Deliveroo saga serves as a stark reminder of the risks associated with investing in the UK market. While the UK still boasts a vibrant and innovative business ecosystem, potential investors need to carefully consider the current economic climate and the challenges outlined above. The government's efforts to attract foreign investment will be crucial in reversing this trend. This includes addressing the skills gap through improved education and training, creating a more stable and predictable regulatory environment, and promoting the UK as a globally competitive investment destination.

Looking Ahead: A Call for Strategic Re-evaluation

The Deliveroo exit should not be interpreted as a death knell for UK business investment. However, it serves as a crucial wake-up call. Businesses need to adopt more sustainable business models, focus on profitability, and carefully manage investor expectations. Investors, in turn, need to conduct thorough due diligence and assess the risks involved before committing capital. The future of UK business investment depends on a more realistic and strategic approach from both sides. Further analysis of the broader macroeconomic factors impacting UK investment is necessary to fully understand the implications of the Deliveroo case and develop effective strategies for future growth. [Link to relevant government report on UK investment].

Call to Action: What are your thoughts on the Deliveroo exit and its implications for UK business investment? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Deliveroo Exit: A Warning Sign For UK Business Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Film Shot Caller Sinopsis Pemeran Dan Jadwal Tayang Di Bioskop Trans Tv 7 Mei 2025

May 08, 2025

Film Shot Caller Sinopsis Pemeran Dan Jadwal Tayang Di Bioskop Trans Tv 7 Mei 2025

May 08, 2025 -

Sheffield Dental Practice Announces Reduction In Patient Capacity Due To Costs

May 08, 2025

Sheffield Dental Practice Announces Reduction In Patient Capacity Due To Costs

May 08, 2025 -

J League 2 Prediction Who Wins Machida Zelvia Vs Kyoto Sanga

May 08, 2025

J League 2 Prediction Who Wins Machida Zelvia Vs Kyoto Sanga

May 08, 2025 -

Warisan Maritim Nusantara Seminar Internasional Di Universitas Nasional Singapura

May 08, 2025

Warisan Maritim Nusantara Seminar Internasional Di Universitas Nasional Singapura

May 08, 2025 -

Israeli Military Action In Yemen Sanaa Airport Under Attack

May 08, 2025

Israeli Military Action In Yemen Sanaa Airport Under Attack

May 08, 2025

Latest Posts

-

Official Final Designs For Queen Elizabeths Memorial Announced

May 08, 2025

Official Final Designs For Queen Elizabeths Memorial Announced

May 08, 2025 -

Daftar 10 Orang Terkaya Asia Menurut Forbes Siapa Saja Mereka

May 08, 2025

Daftar 10 Orang Terkaya Asia Menurut Forbes Siapa Saja Mereka

May 08, 2025 -

Manajemen Psms Medan Akui Tunggakan Gaji Pelatih Dan Pemain

May 08, 2025

Manajemen Psms Medan Akui Tunggakan Gaji Pelatih Dan Pemain

May 08, 2025 -

Bristol Suitcase Murder Victim Teenager Raped And Blackmailed Before Death

May 08, 2025

Bristol Suitcase Murder Victim Teenager Raped And Blackmailed Before Death

May 08, 2025 -

India Vs Pakistan A Military And Nuclear Capabilities Comparison

May 08, 2025

India Vs Pakistan A Military And Nuclear Capabilities Comparison

May 08, 2025 -

Pakistans Response To India A Strategic Assessment Of Four Key Areas

May 08, 2025

Pakistans Response To India A Strategic Assessment Of Four Key Areas

May 08, 2025 -

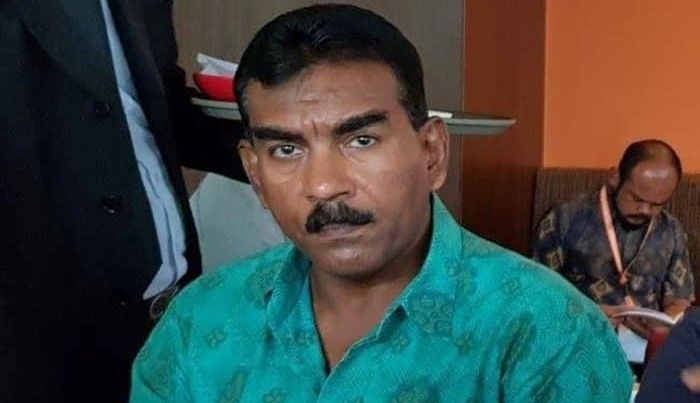

Mantan Gubernur Bengkulu Jalani Sidang Lanjutan Kasus Korupsi Makin Terang

May 08, 2025

Mantan Gubernur Bengkulu Jalani Sidang Lanjutan Kasus Korupsi Makin Terang

May 08, 2025 -

Un Republican Bidens Sharp Criticism Of Trumps Presidency

May 08, 2025

Un Republican Bidens Sharp Criticism Of Trumps Presidency

May 08, 2025 -

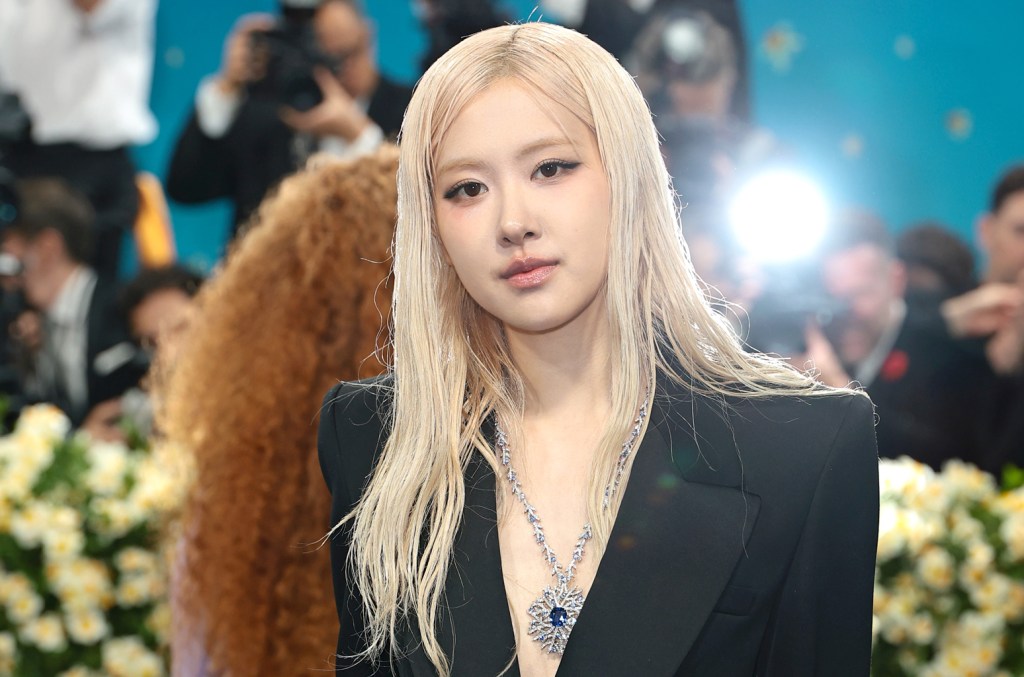

Roses Sharp Ysl Tuxedo A Standout Moment At The 2025 Met Gala

May 08, 2025

Roses Sharp Ysl Tuxedo A Standout Moment At The 2025 Met Gala

May 08, 2025 -

Iga Swiatek Mecz Z Najlepsza Przyjaciolka Emocje Siegna Zenitu

May 08, 2025

Iga Swiatek Mecz Z Najlepsza Przyjaciolka Emocje Siegna Zenitu

May 08, 2025