Shocking UK Savings Statistics: One In Ten Possess No Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Shocking UK Savings Statistics: One in Ten Possess No Savings – A Nation on the Brink?

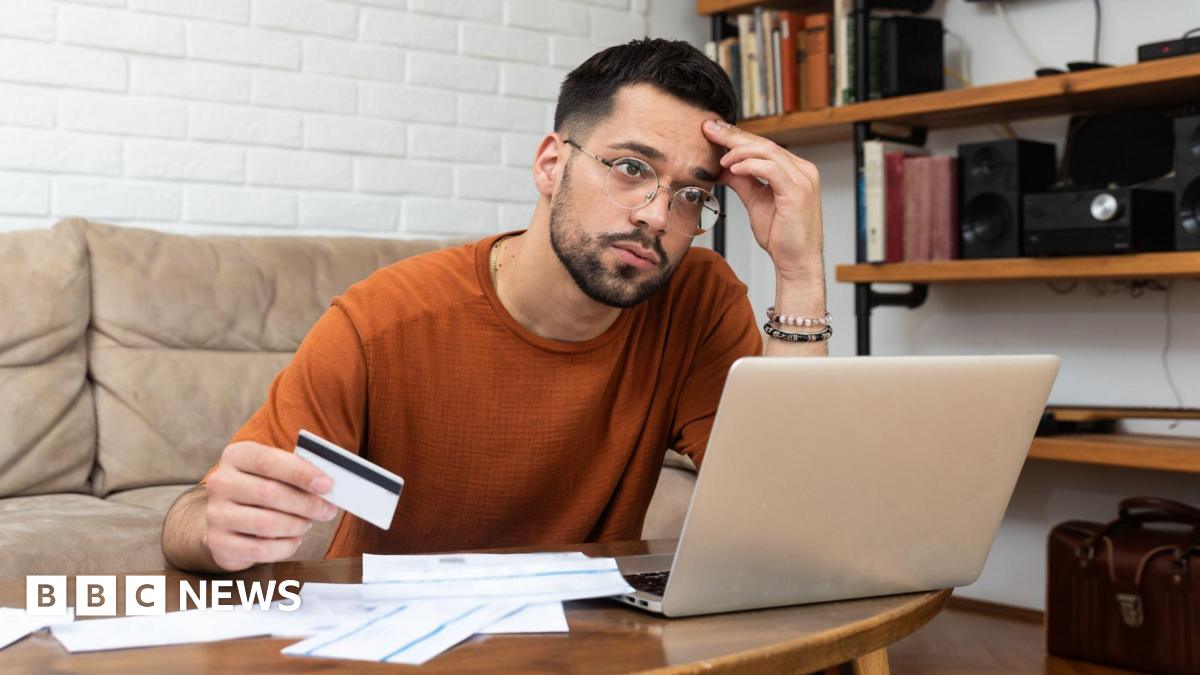

The UK is facing a savings crisis. Recent data reveals a stark reality: a staggering one in ten adults in the UK possess absolutely no savings whatsoever. This shocking statistic paints a worrying picture of financial vulnerability and highlights a growing disparity in the nation's wealth. The implications are far-reaching, impacting everything from retirement planning to the ability to weather unexpected financial emergencies.

This isn't just a problem for individuals; it's a national concern with significant economic ramifications. Let's delve deeper into the alarming details and explore the potential consequences.

The Depth of the Savings Crisis: Key Findings

The latest figures from [Insert Source – reputable financial institution or government report here, e.g., the Office for National Statistics], paint a grim picture. The study found that:

- 10% of UK adults have zero savings: This represents millions of individuals living on a financial knife-edge.

- Significant regional disparities exist: Areas with higher unemployment and lower average incomes show considerably higher percentages of individuals with no savings. [Link to a relevant regional economic report here, if available]

- Age is a factor: Younger adults are disproportionately affected, likely due to high living costs and student debt. [Link to a relevant article on student debt here]

- The impact of inflation: Rising inflation has significantly eroded the value of existing savings, leaving many feeling financially squeezed. [Link to an article discussing inflation's impact on savings here]

The Consequences of a Savings Deficit

The lack of savings has severe implications for individuals and the wider UK economy:

- Increased vulnerability to financial shocks: Unexpected events like job loss, illness, or car repairs can push already struggling families into deep debt.

- Delayed retirement plans: Without adequate savings, many face the prospect of working for longer than planned or a significantly reduced standard of living in retirement.

- Reduced consumer spending: A lack of savings can lead to decreased consumer confidence and reduced spending, potentially hindering economic growth.

- Increased reliance on credit: Individuals with no savings are more likely to rely on high-interest credit, trapping them in a cycle of debt.

What Can Be Done? Addressing the Savings Gap

Tackling this issue requires a multi-pronged approach:

- Financial literacy programs: Improving financial education from a young age is crucial to empowering individuals to make informed financial decisions. [Link to a relevant government initiative on financial literacy]

- Government support schemes: Incentivizing savings through tax breaks or matching contributions could encourage greater participation.

- Addressing income inequality: Reducing the gap between high and low earners is essential to ensuring everyone has the opportunity to save.

- Support for vulnerable groups: Targeted support for low-income families and those facing unemployment can help prevent a further decline in savings.

Conclusion: A Wake-Up Call for the UK

The alarming statistics regarding UK savings highlight a serious societal and economic challenge. Addressing this issue requires immediate action from both individuals and the government. Encouraging responsible saving habits, improving financial literacy, and tackling income inequality are crucial steps towards building a more financially secure future for the UK. The time to act is now, before the crisis deepens further.

Keywords: UK savings, savings crisis, financial vulnerability, UK economy, inflation, retirement planning, financial literacy, income inequality, debt, consumer spending, financial security.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shocking UK Savings Statistics: One In Ten Possess No Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pakta Integritas Disdikbud Batang Pastikan Spmb Yang Berkeadilan Dan Transparan

May 17, 2025

Pakta Integritas Disdikbud Batang Pastikan Spmb Yang Berkeadilan Dan Transparan

May 17, 2025 -

Arson Investigation Update Man Faces Charges Over House Fires

May 17, 2025

Arson Investigation Update Man Faces Charges Over House Fires

May 17, 2025 -

Watch Nuggets Vs Thunder May 13 2025 Final Score And Play By Play

May 17, 2025

Watch Nuggets Vs Thunder May 13 2025 Final Score And Play By Play

May 17, 2025 -

Pendidikan Berkualitas Komitmen Kemendikbudristek Dan Strategi Pemerintah

May 17, 2025

Pendidikan Berkualitas Komitmen Kemendikbudristek Dan Strategi Pemerintah

May 17, 2025 -

Verstappens Ultimatum A Defining Moment For Red Bull And The Future Of F1

May 17, 2025

Verstappens Ultimatum A Defining Moment For Red Bull And The Future Of F1

May 17, 2025

Latest Posts

-

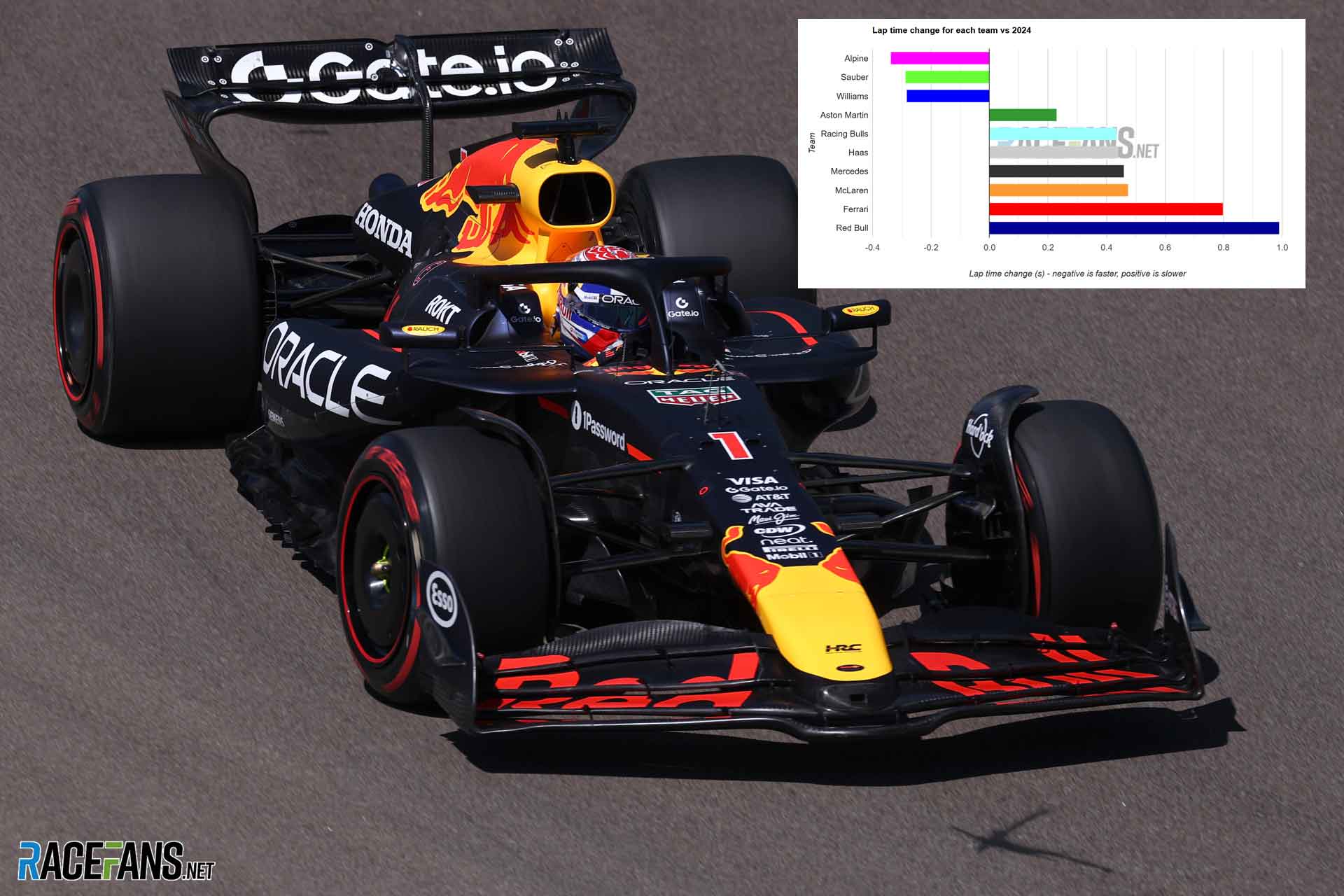

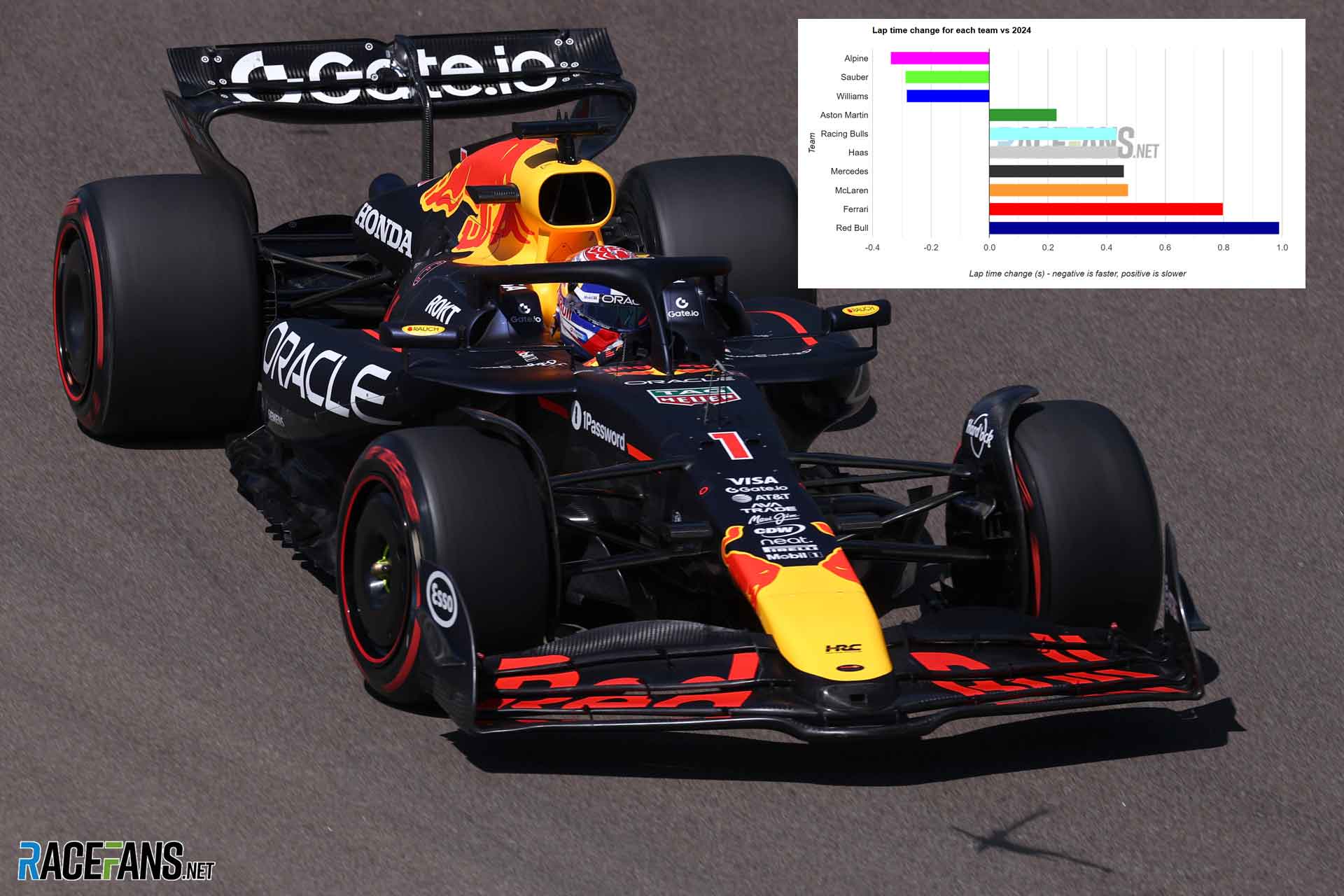

Imola Highlights Red Bulls 2024 Development Gap

May 17, 2025

Imola Highlights Red Bulls 2024 Development Gap

May 17, 2025 -

Red Bulls Verstappen Dilemma Contract Negotiations And The Future Of The Team

May 17, 2025

Red Bulls Verstappen Dilemma Contract Negotiations And The Future Of The Team

May 17, 2025 -

Red Bulls 2024 Pace Imola Race Exposes Significant Challenges

May 17, 2025

Red Bulls 2024 Pace Imola Race Exposes Significant Challenges

May 17, 2025 -

Presiden Cbf Hadapi Tuduhan Tanda Tangan Palsu Reaksi Dan Tanggapan Publik

May 17, 2025

Presiden Cbf Hadapi Tuduhan Tanda Tangan Palsu Reaksi Dan Tanggapan Publik

May 17, 2025 -

No Savings Financial Regulator Highlights Worrying Uk Trend

May 17, 2025

No Savings Financial Regulator Highlights Worrying Uk Trend

May 17, 2025 -

Fastest Growth Headline Masks Challenges For Starmer Post Albania Incident

May 17, 2025

Fastest Growth Headline Masks Challenges For Starmer Post Albania Incident

May 17, 2025 -

Analisis Hukum Respons Terhadap Kasus Korupsi Rita Widyasari Dan Konten Inses Online

May 17, 2025

Analisis Hukum Respons Terhadap Kasus Korupsi Rita Widyasari Dan Konten Inses Online

May 17, 2025 -

Kontrak Diputus Inilah 13 Pembalap Moto Gp Yang Tersingkir Di Tengah Musim

May 17, 2025

Kontrak Diputus Inilah 13 Pembalap Moto Gp Yang Tersingkir Di Tengah Musim

May 17, 2025 -

Nasib Sial Sandy Walsh Jarang Tampil Yokohama F Marinos Terpuruk

May 17, 2025

Nasib Sial Sandy Walsh Jarang Tampil Yokohama F Marinos Terpuruk

May 17, 2025 -

Assisted Dying Bill Key Changes Spark Uk Parliament Debate

May 17, 2025

Assisted Dying Bill Key Changes Spark Uk Parliament Debate

May 17, 2025