Santander's UK Branch Closure Plan: 95 Locations Affected

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Santander's UK Branch Closure Plan: 95 Locations Affected, Sparking Concerns

Santander UK has announced plans to close 95 of its branches across the country, sparking concerns about access to banking services for vulnerable customers and highlighting the ongoing shift towards digital banking. This significant reduction in its physical presence will impact communities nationwide, raising questions about the future of high-street banking.

The closures, scheduled to take place throughout 2024, represent a substantial downsizing for the Spanish banking giant in the UK. While Santander emphasizes the increasing popularity of online and mobile banking, critics argue the move disproportionately affects older and less tech-savvy individuals who rely heavily on in-person banking services.

Which Branches Are Closing?

Santander has not yet released a full list of the 95 branches earmarked for closure. However, the bank has stated that the decision was made based on a range of factors, including branch usage, customer preference, and the proximity of alternative branches. Customers are being urged to check the Santander website for updates and details regarding their specific branch. [Link to Santander's website – ideally a direct link to the branch closure announcement page].

The Impact on Communities:

The closure of 95 branches will undoubtedly have a significant impact on numerous communities across the UK. Many rely on their local Santander branch not only for banking transactions but also for vital services such as advice and support. The loss of these physical locations could lead to:

- Reduced access to banking services: This is particularly concerning for elderly and vulnerable customers who may struggle with online banking.

- Job losses: While Santander has assured employees of support, the closures are expected to lead to job losses amongst branch staff.

- Economic disruption: The closure of branches could negatively affect local businesses and the wider economy.

The Rise of Digital Banking and the Future of High Streets:

Santander's move reflects a broader trend in the banking industry towards digitalization. Many banks are reducing their physical footprints in favor of online and mobile platforms, citing increased efficiency and reduced costs. However, this trend raises important questions about financial inclusion and the accessibility of banking services for all segments of the population.

What Alternatives Are Available?

Santander is encouraging customers to utilize its digital banking platforms, including its mobile app and online banking services. The bank is also highlighting the availability of Post Office banking services for basic transactions. [Link to Post Office banking services information]. Furthermore, the bank has stated it will provide support to affected customers during the transition.

Government Response and Public Opinion:

The announcement has prompted reactions from various quarters. [Mention any government statements or responses if available]. Public opinion is divided, with some understanding the bank's rationale and others expressing concern about the impact on vulnerable individuals and communities. The debate highlights the need for a balance between technological advancement and ensuring equitable access to essential financial services.

Conclusion:

Santander's branch closure plan represents a significant shift in the UK banking landscape. While the move reflects the ongoing digital transformation of the sector, it also raises important questions about financial inclusion and the future of high-street banking. The coming months will be crucial in assessing the impact of these closures and determining the necessary measures to mitigate any negative consequences for affected communities. Keep checking back for updates as the situation develops.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Santander's UK Branch Closure Plan: 95 Locations Affected. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Vs Albania Betting Free 40 Bet Offer

Mar 21, 2025

England Vs Albania Betting Free 40 Bet Offer

Mar 21, 2025 -

Ferraris F1 Pace Puzzle Hamiltons Unexpected Pole Position

Mar 21, 2025

Ferraris F1 Pace Puzzle Hamiltons Unexpected Pole Position

Mar 21, 2025 -

How Authorities Stopped Nicholas Prospers Planned School Massacre

Mar 21, 2025

How Authorities Stopped Nicholas Prospers Planned School Massacre

Mar 21, 2025 -

Security Concerns Dominate In Camera Meeting As Opposition Walks Out

Mar 21, 2025

Security Concerns Dominate In Camera Meeting As Opposition Walks Out

Mar 21, 2025 -

Milwaukee Woman Deported To Laos Following Jail Time

Mar 21, 2025

Milwaukee Woman Deported To Laos Following Jail Time

Mar 21, 2025

Latest Posts

-

Menuju Profesionalisme Analisis Kesuksesan Persebaya Dan Arema Fc Dalam Mendapatkan Lisensi Klub

May 09, 2025

Menuju Profesionalisme Analisis Kesuksesan Persebaya Dan Arema Fc Dalam Mendapatkan Lisensi Klub

May 09, 2025 -

Video Bill Gates Donasikan Dana Ke Indonesia Pm Kanada Menolak

May 09, 2025

Video Bill Gates Donasikan Dana Ke Indonesia Pm Kanada Menolak

May 09, 2025 -

Niespodzianka Iga Swiatek Zagra Z Najlepsza Przyjaciolka

May 09, 2025

Niespodzianka Iga Swiatek Zagra Z Najlepsza Przyjaciolka

May 09, 2025 -

Bill Gates Sumbangkan Rp1 651 Triliun Masa Depan Anak Anaknya Terjamin

May 09, 2025

Bill Gates Sumbangkan Rp1 651 Triliun Masa Depan Anak Anaknya Terjamin

May 09, 2025 -

Rp 195 Juta Untuk Jabatan Pengakuan Kadis Kepada Rohidin Mersyah

May 09, 2025

Rp 195 Juta Untuk Jabatan Pengakuan Kadis Kepada Rohidin Mersyah

May 09, 2025 -

Kiprah Shayne Pattynama Di Kas Eupen Analisis Sebelum Transfer

May 09, 2025

Kiprah Shayne Pattynama Di Kas Eupen Analisis Sebelum Transfer

May 09, 2025 -

Kasus Suap Rp 195 Juta Untuk Pertahankan Jabatan Pengakuan Kadis

May 09, 2025

Kasus Suap Rp 195 Juta Untuk Pertahankan Jabatan Pengakuan Kadis

May 09, 2025 -

Dana Politik Rp 3 4 Miliar Kejelasan Aliran Dana Dari Rohidin Ke Kaur Dipertanyakan

May 09, 2025

Dana Politik Rp 3 4 Miliar Kejelasan Aliran Dana Dari Rohidin Ke Kaur Dipertanyakan

May 09, 2025 -

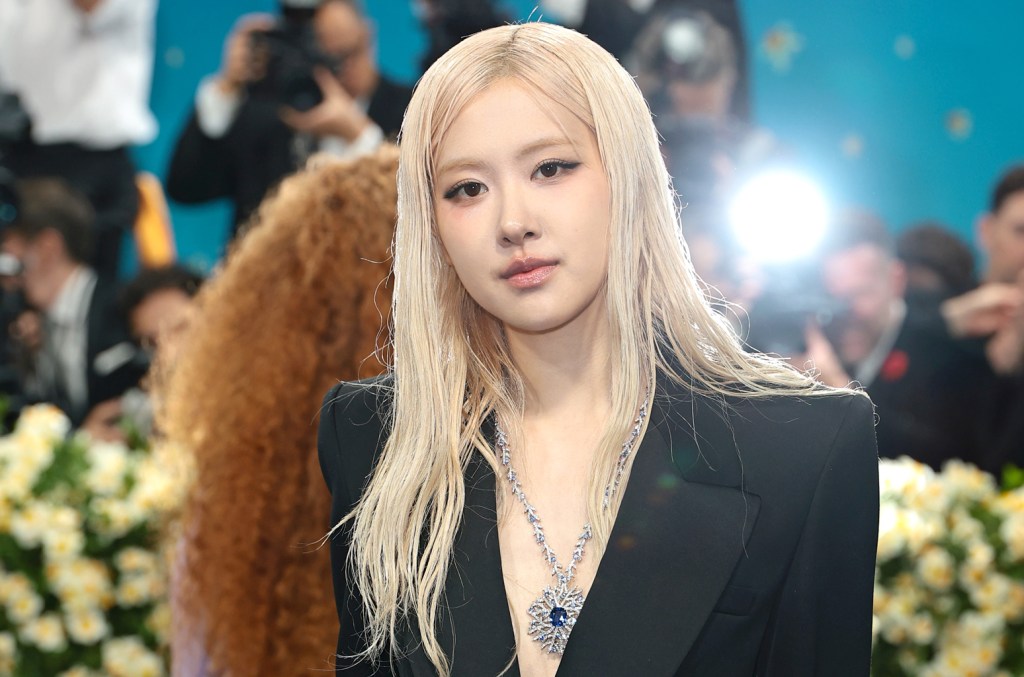

Roses Yves Saint Laurent Tuxedo A Met Gala 2025 Highlight

May 09, 2025

Roses Yves Saint Laurent Tuxedo A Met Gala 2025 Highlight

May 09, 2025 -

Forbes Umumkan Daftar 10 Orang Terkaya Asia Indonesia Absen

May 09, 2025

Forbes Umumkan Daftar 10 Orang Terkaya Asia Indonesia Absen

May 09, 2025