S&P 500 Vs. Growth Stocks: 2025 Performance Comparison And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 vs. Growth Stocks: 2025 Performance Comparison and Predictions

The ongoing debate between investing in the S&P 500 versus focusing on growth stocks is a perennial one, especially when considering long-term performance. But what does the future hold? This article dives deep into a comparative analysis of the S&P 500 and growth stocks, offering informed predictions for their performance in 2025 and beyond. We'll examine key factors influencing their trajectory and provide insights to help you make informed investment decisions.

Understanding the Contenders:

Before we delve into predictions, let's clarify what we mean. The S&P 500 represents a broad market index encompassing 500 large-cap U.S. companies across various sectors. It's often considered a benchmark for overall market performance and offers diversification. Conversely, growth stocks are shares of companies anticipated to experience above-average earnings growth. These are typically found in technology, healthcare, and consumer discretionary sectors, but can span various industries. They often carry higher risk but potentially offer greater rewards.

Factors Influencing 2025 Performance:

Several macroeconomic factors will significantly impact both the S&P 500 and growth stocks in 2025:

- Interest Rates: The Federal Reserve's monetary policy will play a crucial role. Higher interest rates generally favor value stocks (often found within the S&P 500) and can dampen the growth prospects of high-growth companies reliant on future earnings. A shift towards lower rates could benefit growth stocks.

- Inflation: Persistent inflation erodes purchasing power and impacts corporate profitability. Both the S&P 500 and growth stocks are susceptible, but growth stocks, with their higher valuations, may be more vulnerable.

- Geopolitical Events: Global instability and unforeseen events can create significant market volatility, impacting both investment categories.

- Technological Innovation: Breakthroughs in technology can disproportionately benefit growth stocks, particularly those involved in AI, renewable energy, and biotechnology.

S&P 500 Predictions for 2025:

Predicting market performance with certainty is impossible. However, based on current trends and expert analyses, the S&P 500 is expected to show moderate growth in 2025. Analysts generally predict a steady, albeit potentially slower, pace compared to previous years, reflecting a more cautious market environment. Factors like interest rate adjustments and inflation will play a key role in determining the exact figures. Several financial institutions offer their own projections – it's wise to consult a range of opinions.

Growth Stock Predictions for 2025:

Growth stocks, due to their higher risk profile, present a more complex prediction landscape. While some high-growth companies might continue to thrive, driven by technological advancements and strong market demand, others may face challenges if interest rates remain high or if economic growth slows. Selective investing within the growth sector will be crucial. Identifying companies with strong fundamentals and sustainable competitive advantages will be key to achieving positive returns.

S&P 500 vs. Growth Stocks: A 2025 Comparison:

It's highly likely that the performance gap between the S&P 500 and growth stocks in 2025 will be relatively narrow compared to previous periods of significant disparity. The overall economic climate will significantly influence the outcome. A stable, moderate growth environment might see both sectors delivering comparable returns, while periods of uncertainty or rapid change could favor one over the other.

Investment Strategies:

Ultimately, the best investment strategy depends on individual risk tolerance and financial goals. A diversified portfolio, incorporating both S&P 500 index funds and selectively chosen growth stocks, might offer a balanced approach. Consult with a qualified financial advisor to create a personalized investment plan tailored to your specific circumstances.

Disclaimer: This article provides general information and should not be considered financial advice. Investing involves risk, and past performance is not indicative of future results.

Call to Action: Stay informed about market trends by regularly reviewing reputable financial news sources and consulting with a financial advisor. Understanding the nuances of S&P 500 and growth stock investing is crucial for making informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Vs. Growth Stocks: 2025 Performance Comparison And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jadwal Tayang Arsenal Vs Psg Liga Champions 2024

Apr 29, 2025

Jadwal Tayang Arsenal Vs Psg Liga Champions 2024

Apr 29, 2025 -

Stoltenberg And Pistorius Ukraine Must Not Make Territorial Concessions

Apr 29, 2025

Stoltenberg And Pistorius Ukraine Must Not Make Territorial Concessions

Apr 29, 2025 -

State Of Emergency In Spain As Portugal Battles Widespread Power Cuts And Travel Disruptions

Apr 29, 2025

State Of Emergency In Spain As Portugal Battles Widespread Power Cuts And Travel Disruptions

Apr 29, 2025 -

Are These Growth Stocks The Next Big Winners 2025 Market Outlook

Apr 29, 2025

Are These Growth Stocks The Next Big Winners 2025 Market Outlook

Apr 29, 2025 -

De Graafschap Verliest Van Vvv Venlo Wedstrijddetails En Samenvatting

Apr 29, 2025

De Graafschap Verliest Van Vvv Venlo Wedstrijddetails En Samenvatting

Apr 29, 2025

Latest Posts

-

Live Stream And Tv Broadcast Details Arango Vs Andreeva At The 2025 Internazionali Bnl D Italia

May 09, 2025

Live Stream And Tv Broadcast Details Arango Vs Andreeva At The 2025 Internazionali Bnl D Italia

May 09, 2025 -

Xatar Tot Fans Nehmen Abschied Von Dem Erfolgreichen Musiker

May 09, 2025

Xatar Tot Fans Nehmen Abschied Von Dem Erfolgreichen Musiker

May 09, 2025 -

Andreeva Dominates Arango In Rome Raducanu Moves On

May 09, 2025

Andreeva Dominates Arango In Rome Raducanu Moves On

May 09, 2025 -

Peluang Besar Persebaya Untuk Menang Atas Semen Padang

May 09, 2025

Peluang Besar Persebaya Untuk Menang Atas Semen Padang

May 09, 2025 -

Film Mosul Sinopsis Lengkap Dan Jadwal Tayang Di Bioskop Trans Tv 9 Mei 2025

May 09, 2025

Film Mosul Sinopsis Lengkap Dan Jadwal Tayang Di Bioskop Trans Tv 9 Mei 2025

May 09, 2025 -

Film Pilihan Trans Tv Jadwal Tayang Dan Sinopsis 9 Mei 2025

May 09, 2025

Film Pilihan Trans Tv Jadwal Tayang Dan Sinopsis 9 Mei 2025

May 09, 2025 -

Dua Laga Penting Dewa United Esports Tantangan Pekan Ini

May 09, 2025

Dua Laga Penting Dewa United Esports Tantangan Pekan Ini

May 09, 2025 -

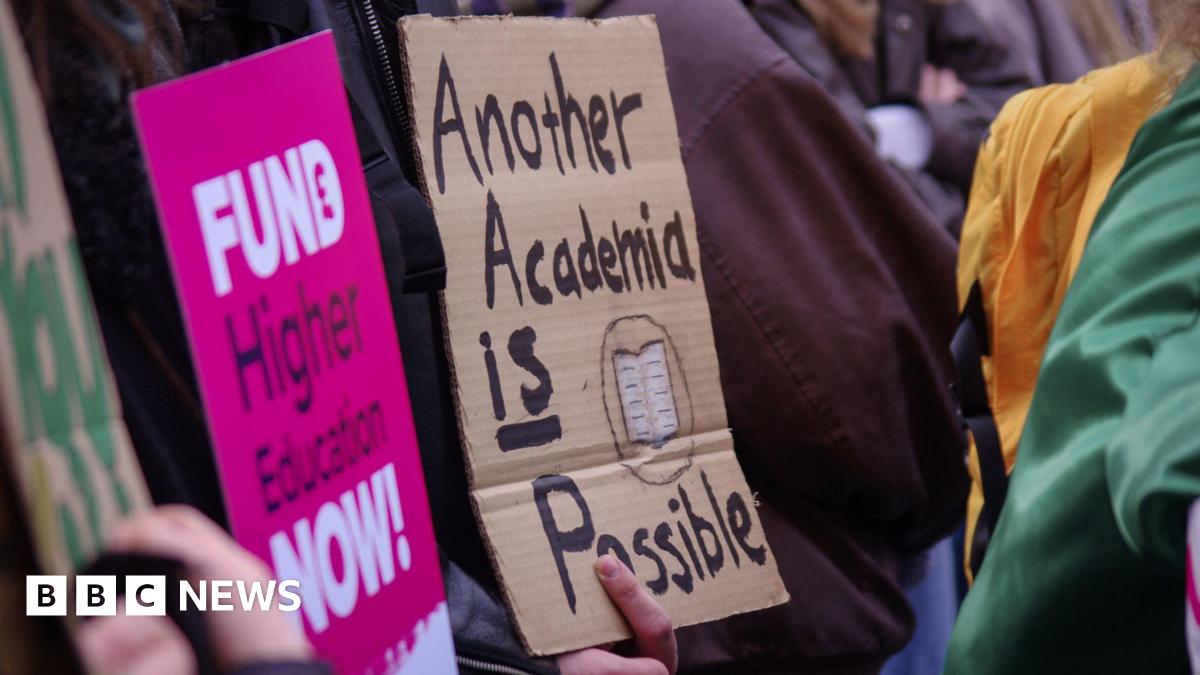

Four In Ten Universities Struggle Financially A Growing Crisis

May 09, 2025

Four In Ten Universities Struggle Financially A Growing Crisis

May 09, 2025 -

Cek Bansos Pkh 2025 Online Langkah Mudah Via Hp Dengan Nik Ktp

May 09, 2025

Cek Bansos Pkh 2025 Online Langkah Mudah Via Hp Dengan Nik Ktp

May 09, 2025 -

Perkuat Kolaborasi Pemerintah Dorong Keberhasilan Koperasi Desa Merah Putih

May 09, 2025

Perkuat Kolaborasi Pemerintah Dorong Keberhasilan Koperasi Desa Merah Putih

May 09, 2025