MPs Push For Farm Inheritance Tax Reform: A One-Year Delay

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MPs Push for Farm Inheritance Tax Reform: A One-Year Delay Could Ease Rural Crisis

The future of farming in the UK is hanging in the balance, with mounting pressure on the government to reform inheritance tax laws affecting agricultural land. A significant coalition of MPs is now pushing for a one-year delay in the implementation of current inheritance tax rules, arguing that the current system is driving many family farms to the brink of collapse. This proposed delay aims to provide breathing room for farmers and allow time for a more comprehensive and fairer reform.

The Current Crisis Facing Family Farms

The UK's agricultural sector is facing unprecedented challenges. Rising inflation, volatile energy prices, and the ongoing impact of Brexit are placing immense strain on farmers' finances. Adding to these difficulties are the complexities and potentially crippling costs of inheritance tax, often forcing families to sell land and livestock to meet tax obligations. This often leads to the fragmentation of farms and the loss of valuable agricultural expertise passed down through generations. Many fear this trend will significantly impact the UK's food security and rural communities.

The Proposed One-Year Delay: A Crucial Reprieve?

The proposed one-year delay in inheritance tax implementation isn't simply a postponement; MPs argue it's a vital opportunity to reassess the current legislation and develop a more sustainable solution. This temporary reprieve would give farmers time to plan for the future, potentially securing additional funding or finding alternative ways to meet tax liabilities without sacrificing their livelihoods. The hope is that this breathing space will allow for a more considered review of the tax system, leading to fairer and more effective long-term solutions.

Key Arguments for Reform:

- Protecting Family Businesses: Many MPs highlight that family farms are not simply businesses; they are a vital part of the UK’s heritage and rural fabric. Losing these farms would have far-reaching social and economic consequences.

- Ensuring Food Security: A thriving agricultural sector is crucial for food security. The loss of family farms could lead to a decline in domestic food production and increased reliance on imports.

- Supporting Rural Communities: Family farms are the backbone of many rural communities, providing employment and supporting local businesses. Their demise would have a devastating impact on these already vulnerable areas.

What Happens Next?

The proposal for a one-year delay is currently under consideration. While the government hasn't officially responded, pressure is mounting for a swift and positive outcome. Several influential farming organizations have voiced their strong support for the delay, highlighting the urgent need for action. The coming weeks and months will be crucial in determining the future of this vital legislation and the future of family farms across the UK. We will continue to provide updates on this developing story as they become available.

Further Reading:

Call to Action: Stay informed about this crucial issue by subscribing to our newsletter for regular updates on agricultural policy and the fight for fairer inheritance tax laws. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MPs Push For Farm Inheritance Tax Reform: A One-Year Delay. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Simak Detail Upacara Harkitnas 2025 Di Museum Kebangkitan Nasional

May 17, 2025

Simak Detail Upacara Harkitnas 2025 Di Museum Kebangkitan Nasional

May 17, 2025 -

Moto Gp 2024 Daftar 13 Pembalap Yang Kehilangan Kursi Di Tengah Jalan

May 17, 2025

Moto Gp 2024 Daftar 13 Pembalap Yang Kehilangan Kursi Di Tengah Jalan

May 17, 2025 -

Nightly Nba Pulse Game Results And Top Performances May 15

May 17, 2025

Nightly Nba Pulse Game Results And Top Performances May 15

May 17, 2025 -

Police Charge Chris Brown With Assault After London Club Incident

May 17, 2025

Police Charge Chris Brown With Assault After London Club Incident

May 17, 2025 -

Gosip Tetangga Menghibur Inilah Sinopsis Film Cocote Tonggo

May 17, 2025

Gosip Tetangga Menghibur Inilah Sinopsis Film Cocote Tonggo

May 17, 2025

Latest Posts

-

Aktor Film Cocote Tonggo Jelajahi Sentra Tenun Kediri

May 18, 2025

Aktor Film Cocote Tonggo Jelajahi Sentra Tenun Kediri

May 18, 2025 -

Depok Airgun Ketua Grib Jaya Melukai Pekerja Konstruksi

May 18, 2025

Depok Airgun Ketua Grib Jaya Melukai Pekerja Konstruksi

May 18, 2025 -

Uk Financial Regulator Highlights Savings Gap One In Ten Britons With No Savings

May 18, 2025

Uk Financial Regulator Highlights Savings Gap One In Ten Britons With No Savings

May 18, 2025 -

Mps Push For Farm Inheritance Tax Delay A Year To Plan For The Future

May 18, 2025

Mps Push For Farm Inheritance Tax Delay A Year To Plan For The Future

May 18, 2025 -

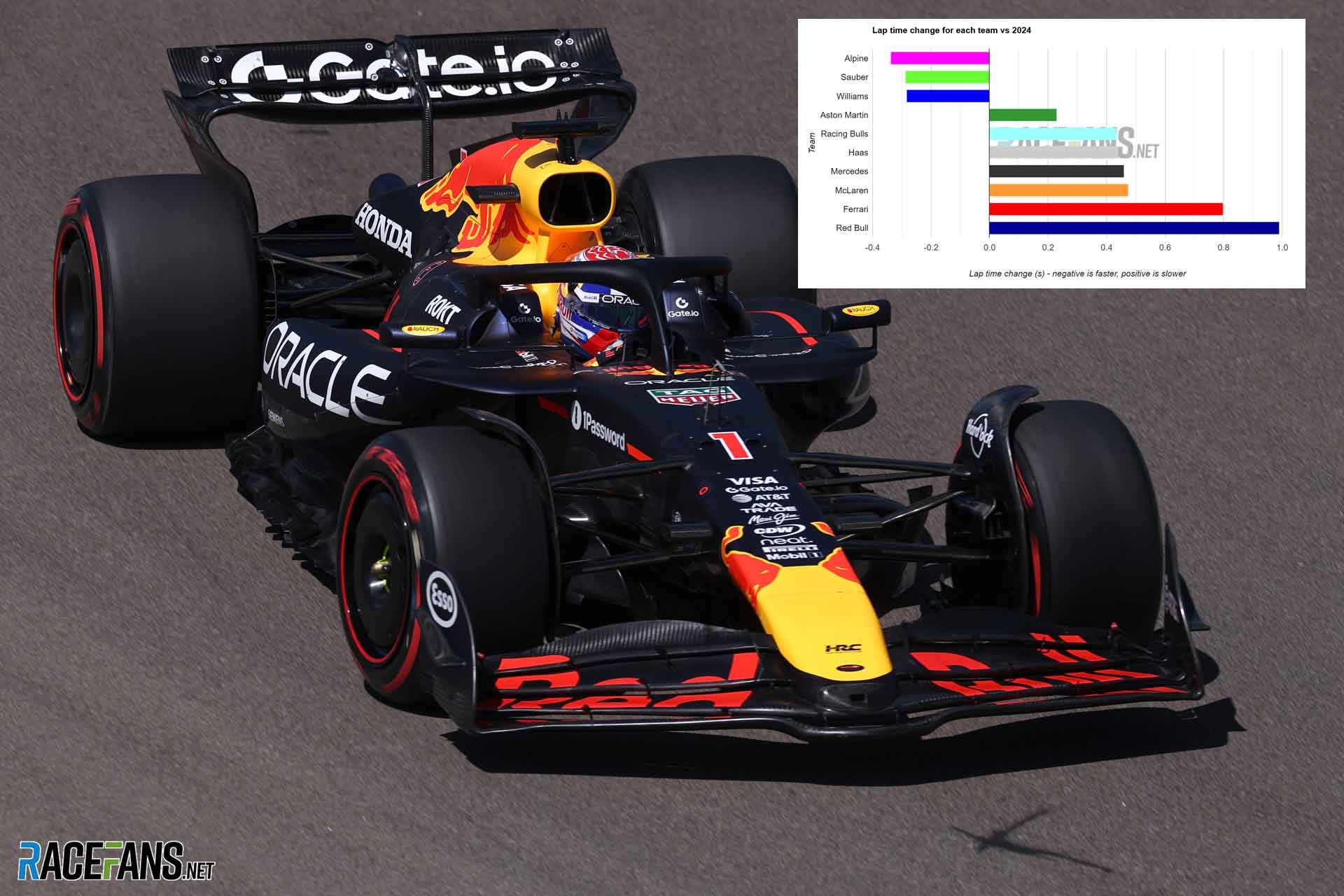

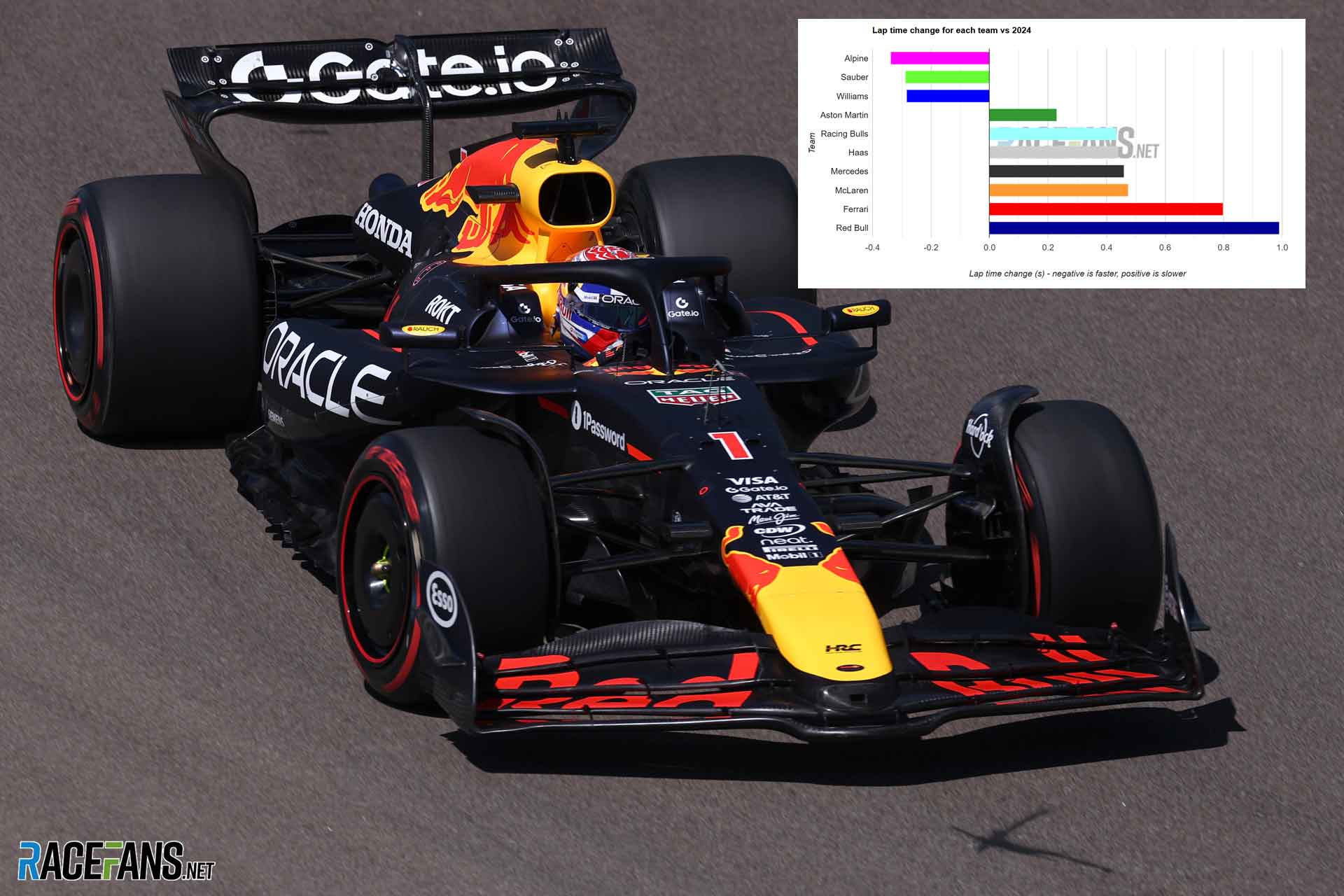

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025 -

Red Bulls Imola Performance A Significant Gap To 2024 Targets

May 18, 2025

Red Bulls Imola Performance A Significant Gap To 2024 Targets

May 18, 2025 -

Jadwal Pendaftaran Stin 2025 Kapan Dibuka Dan Persyaratannya

May 18, 2025

Jadwal Pendaftaran Stin 2025 Kapan Dibuka Dan Persyaratannya

May 18, 2025 -

Australian War Heros Defamation Appeal Fails Full Breakdown Of The Ruling

May 18, 2025

Australian War Heros Defamation Appeal Fails Full Breakdown Of The Ruling

May 18, 2025 -

London Nightclub Assault Chris Brown Faces Criminal Charges

May 18, 2025

London Nightclub Assault Chris Brown Faces Criminal Charges

May 18, 2025 -

Inheritance Tax On Farms Mps Urge Government For 12 Month Extension

May 18, 2025

Inheritance Tax On Farms Mps Urge Government For 12 Month Extension

May 18, 2025