Indonesia's Rupiah Hits Rp16,850: Governor Warjiyo's Economic Policies At Play

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Indonesia's Rupiah Hits Rp16,850: Governor Warjiyo's Economic Policies at Play

Indonesia's rupiah weakened to Rp16,850 against the US dollar on [Insert Date], marking a significant fluctuation in the country's currency. This movement has sparked discussions about the effectiveness of Governor Perry Warjiyo's economic policies and their impact on the Indonesian economy. While the weakening rupiah presents challenges, analysts offer varied perspectives on its long-term implications.

Understanding the Rupiah's Recent Weakness

Several factors contribute to the rupiah's current position. The global economic slowdown, rising US interest rates, and persistent inflation globally all play a significant role. The strengthening US dollar, a haven currency during times of uncertainty, further pressures emerging market currencies like the Indonesian rupiah. [Link to a reputable source discussing global economic trends].

Domestically, Indonesia's current account deficit and its reliance on commodity exports add to the volatility. Fluctuations in global commodity prices directly impact Indonesia's export earnings, influencing the rupiah's value. Furthermore, potential changes in foreign investment flows can significantly affect the currency exchange rate.

Governor Warjiyo's Response and Economic Strategies

Governor Warjiyo of Bank Indonesia (BI) has implemented several measures to manage the rupiah's volatility and stabilize the economy. These strategies include:

- Interest Rate Hikes: BI has strategically increased its benchmark interest rate to attract foreign investment and curb inflation. This makes Indonesian assets more appealing to international investors, potentially boosting demand for the rupiah. [Link to a BI press release on interest rate changes].

- Intervention in the Foreign Exchange Market: BI has reportedly intervened in the forex market to manage the rupiah's fluctuations, buying or selling dollars to influence the exchange rate. This action aims to prevent excessive volatility and maintain a degree of stability.

- Macroprudential Policies: BI has also employed macroprudential measures aimed at strengthening the financial system and reducing risks. These policies focus on maintaining stability within the broader financial landscape. [Link to a reputable source explaining BI's macroprudential policies].

Analyzing the Effectiveness of Current Policies

The effectiveness of Governor Warjiyo's policies remains a subject of ongoing debate. While some analysts credit his proactive measures for preventing a sharper decline in the rupiah, others argue that more aggressive interventions are needed. The long-term consequences of the current economic climate and the effectiveness of BI's response will continue to unfold.

Potential Future Scenarios and Outlook for the Rupiah

The future trajectory of the rupiah depends on various factors, including global economic conditions, commodity prices, and the effectiveness of BI's ongoing policies. A sustained improvement in the global economic outlook could positively impact the rupiah. Conversely, further escalation of global uncertainties could lead to increased pressure on the currency.

Conclusion: Navigating Economic Uncertainty

Indonesia's economy, while resilient, faces significant headwinds. The weakening rupiah underscores the challenges of navigating a volatile global landscape. Governor Warjiyo's economic policies are crucial in managing this volatility and ensuring macroeconomic stability. The coming months will be critical in evaluating the long-term success of these strategies and their overall impact on the Indonesian economy. Monitoring global economic indicators and BI’s policy pronouncements will be key to understanding the future of the rupiah.

Keywords: Indonesian Rupiah, Rupiah exchange rate, Bank Indonesia, Governor Warjiyo, Indonesian economy, inflation, interest rates, foreign exchange market, global economic slowdown, US dollar, current account deficit, macroprudential policies, economic policies, emerging market currency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indonesia's Rupiah Hits Rp16,850: Governor Warjiyo's Economic Policies At Play. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Launched After Statues Damaged At London Transgender Protest

Apr 23, 2025

Investigation Launched After Statues Damaged At London Transgender Protest

Apr 23, 2025 -

Semua Kalangan Diajak Ikut Isoplus Run 2025 Di Jakarta And Surabaya

Apr 23, 2025

Semua Kalangan Diajak Ikut Isoplus Run 2025 Di Jakarta And Surabaya

Apr 23, 2025 -

Resep Bi Di Bawah Perry Warjiyo Rupiah Tembus Rp16 850

Apr 23, 2025

Resep Bi Di Bawah Perry Warjiyo Rupiah Tembus Rp16 850

Apr 23, 2025 -

Analyst Warns Of Mania Gold Hits 3 500 On Dollar Weakness And Fed Actions

Apr 23, 2025

Analyst Warns Of Mania Gold Hits 3 500 On Dollar Weakness And Fed Actions

Apr 23, 2025 -

Market Reaction Us Equities And Dollar Decline After Trump Powell Clash

Apr 23, 2025

Market Reaction Us Equities And Dollar Decline After Trump Powell Clash

Apr 23, 2025

Latest Posts

-

I Was On The Flight Says Passenger British Airways Says Otherwise

May 18, 2025

I Was On The Flight Says Passenger British Airways Says Otherwise

May 18, 2025 -

Premier League Preview Everton Vs Southampton Team News And Prediction

May 18, 2025

Premier League Preview Everton Vs Southampton Team News And Prediction

May 18, 2025 -

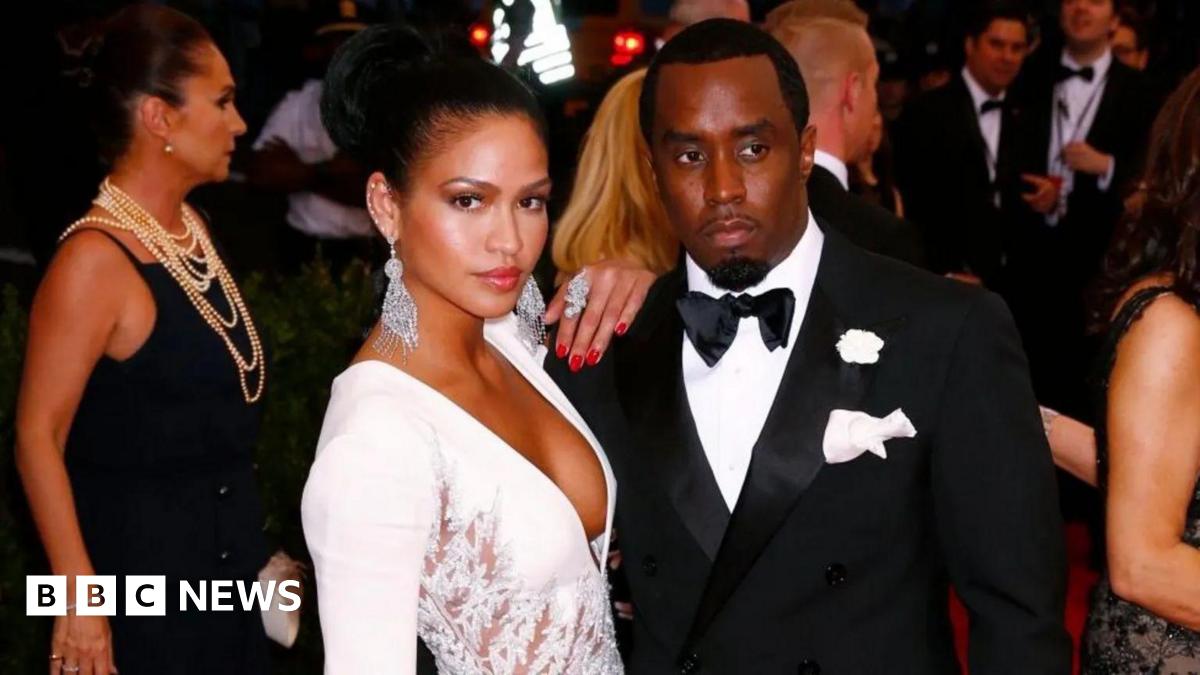

Sean Combs Legal Battle Ex Girlfriend Cassies Crucial Role

May 18, 2025

Sean Combs Legal Battle Ex Girlfriend Cassies Crucial Role

May 18, 2025 -

Target Kemenangan Psbs Biak Vs Arema Fc Duel Sengit Di Stadion

May 18, 2025

Target Kemenangan Psbs Biak Vs Arema Fc Duel Sengit Di Stadion

May 18, 2025 -

Trumps Seashell Post James Comeys Interview With The Secret Service Explained

May 18, 2025

Trumps Seashell Post James Comeys Interview With The Secret Service Explained

May 18, 2025 -

Live Streaming World Ssp Race 1 World Sbk Czech Round 2025

May 18, 2025

Live Streaming World Ssp Race 1 World Sbk Czech Round 2025

May 18, 2025 -

Did Trumps Peace Efforts Reveal His True Intentions A Behind The Scenes Look

May 18, 2025

Did Trumps Peace Efforts Reveal His True Intentions A Behind The Scenes Look

May 18, 2025 -

Matchday Preview Evertons Clash Against Southampton Lineups And Prediction

May 18, 2025

Matchday Preview Evertons Clash Against Southampton Lineups And Prediction

May 18, 2025 -

Film Dendam Kelam Malam Marissa Anita Dan Pengaruh Robert Greene

May 18, 2025

Film Dendam Kelam Malam Marissa Anita Dan Pengaruh Robert Greene

May 18, 2025 -

Winter Fuel Crisis Averted Government Unveils New Eu Agreement And Funding Plan

May 18, 2025

Winter Fuel Crisis Averted Government Unveils New Eu Agreement And Funding Plan

May 18, 2025