IHSG Menguat: Strategi Investasi Di Tengah Antisipasi Neraca Perdagangan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IHSG Menguat: Strategi Investasi di Tengah Antisipasi Neraca Perdagangan

Indeks Harga Saham Gabungan (IHSG) mencatatkan penguatan yang signifikan, memicu optimisme di pasar modal Indonesia. Namun, antisipasi terhadap rilis data neraca perdagangan bulan Juli 2023 menambah kompleksitas bagi para investor. Bagaimana strategi investasi yang tepat di tengah situasi ini?

Indonesia's stock market, as measured by the Jakarta Composite Index (IHSG), has shown impressive strength recently, leaving investors cautiously optimistic. This positive trend, however, is intertwined with the upcoming release of July 2023's trade balance data, creating a complex landscape for investment decisions. Understanding this interplay is crucial for navigating the market effectively.

Penguatan IHSG: Faktor-faktor Pendukung

Several factors have contributed to the recent IHSG surge. These include:

- Sentimen global yang membaik: A more positive global economic outlook, fueled by easing inflation concerns in some major economies, has boosted investor confidence worldwide, including in Indonesia.

- Kinerja ekonomi domestik yang relatif kuat: Indonesia's relatively resilient domestic economy, despite global headwinds, has provided a buffer against broader market volatility. Strong consumption and investment activity continue to underpin growth.

- Program pemerintah yang mendorong investasi: Government initiatives aimed at attracting foreign and domestic investment have played a role in boosting market sentiment. These programs aim to further stimulate economic growth and attract capital inflow.

- Minat investor asing: Increased interest from foreign investors has injected liquidity into the market, pushing up share prices.

Antisipasi Neraca Perdagangan Juli 2023: Tantangan dan Peluang

The upcoming release of July 2023's trade balance data presents both challenges and opportunities. A surplus would likely bolster investor confidence further, driving IHSG higher. However, a deficit could trigger a correction, leading to a period of market consolidation or even decline.

Strategi Investasi yang Bijak

Given the current market dynamics, a prudent investment strategy should incorporate the following elements:

- Diversifikasi portofolio: Spreading investments across different sectors and asset classes is vital to mitigate risk. This reduces exposure to any single sector's potential downturn.

- Analisis fundamental yang mendalam: Thorough fundamental analysis of individual companies is crucial. Understanding a company's financial health, competitive landscape, and growth prospects is essential for making informed decisions.

- Pemantauan indikator ekonomi makro: Closely monitoring key macroeconomic indicators, including inflation, interest rates, and currency exchange rates, is essential for understanding the broader economic context and its impact on the market.

- Perencanaan jangka panjang: Adopting a long-term investment horizon helps mitigate the impact of short-term market fluctuations. This approach allows investors to ride out temporary market corrections.

- Konsultasi dengan ahli keuangan: Seeking advice from a qualified financial advisor can provide valuable insights and personalized guidance tailored to your risk tolerance and financial goals.

Kesimpulan

The current IHSG strengthening presents both exciting opportunities and potential risks. By adopting a well-diversified portfolio, conducting thorough research, and carefully monitoring macroeconomic indicators, investors can navigate this complex market effectively and potentially capitalize on the current upward trend. Remember to always consult with a financial professional before making any significant investment decisions. Understanding the intricacies of the Indonesian economy and its interaction with global markets is crucial for success in this dynamic environment. Stay informed, and make smart choices.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IHSG Menguat: Strategi Investasi Di Tengah Antisipasi Neraca Perdagangan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Clasificacion En Juego Palabras De Antonio Alvarez Presidente De Barcelona Sporting Club

May 15, 2025

Clasificacion En Juego Palabras De Antonio Alvarez Presidente De Barcelona Sporting Club

May 15, 2025 -

San Jose Earthquakes Prepare For High Profile Match Against Messis Inter Miami

May 15, 2025

San Jose Earthquakes Prepare For High Profile Match Against Messis Inter Miami

May 15, 2025 -

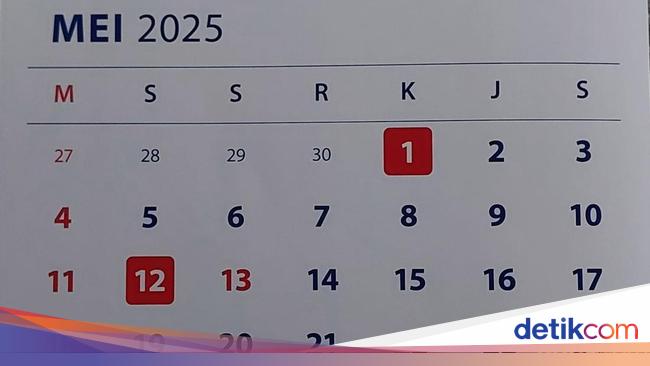

15 Mei Peringatan Hari Apa Di Indonesia Dan Dunia

May 15, 2025

15 Mei Peringatan Hari Apa Di Indonesia Dan Dunia

May 15, 2025 -

Pasar Indonesia Menarik Dana Asing Berebut Masuk Cetak Rekor Baru

May 15, 2025

Pasar Indonesia Menarik Dana Asing Berebut Masuk Cetak Rekor Baru

May 15, 2025 -

How To Watch Todays Lafc Vs Seattle Sounders Mls Game

May 15, 2025

How To Watch Todays Lafc Vs Seattle Sounders Mls Game

May 15, 2025

Latest Posts

-

Londons Civil Service Decline Thousands Of Jobs Relocating

May 15, 2025

Londons Civil Service Decline Thousands Of Jobs Relocating

May 15, 2025 -

Trumps Middle East Policy Shift Analysis Of Saudi Arms Deal And Syria Sanctions

May 15, 2025

Trumps Middle East Policy Shift Analysis Of Saudi Arms Deal And Syria Sanctions

May 15, 2025 -

World Reacts To The Death Of Jose Mujica Uruguays Beloved Ex President

May 15, 2025

World Reacts To The Death Of Jose Mujica Uruguays Beloved Ex President

May 15, 2025 -

Casandra Ventura Details Alleged Abuse By Diddy In Emotional Court Appearance

May 15, 2025

Casandra Ventura Details Alleged Abuse By Diddy In Emotional Court Appearance

May 15, 2025 -

Menarik Siswa Baru Ke Madrasah Kiat Ampuh Jelang Ppdb Mei

May 15, 2025

Menarik Siswa Baru Ke Madrasah Kiat Ampuh Jelang Ppdb Mei

May 15, 2025 -

Will Uk Television Channels Thrive Or Fade In The Age Of Streaming

May 15, 2025

Will Uk Television Channels Thrive Or Fade In The Age Of Streaming

May 15, 2025 -

San Jose Earthquakes Prepare For High Profile Match Against Messis Inter Miami

May 15, 2025

San Jose Earthquakes Prepare For High Profile Match Against Messis Inter Miami

May 15, 2025 -

Liga Mx Apuestas Y Pronosticos Para Las Semifinales Del Clausura 2025

May 15, 2025

Liga Mx Apuestas Y Pronosticos Para Las Semifinales Del Clausura 2025

May 15, 2025 -

Mantan Gubernur Jatim Syl Resmi Ditahan Di Lapas Sukamiskin

May 15, 2025

Mantan Gubernur Jatim Syl Resmi Ditahan Di Lapas Sukamiskin

May 15, 2025 -

Pemain Lafc Adrian Wibowo Bangga Berdarah Indonesia Satu Tim Dengan Giroud Dan Lloris

May 15, 2025

Pemain Lafc Adrian Wibowo Bangga Berdarah Indonesia Satu Tim Dengan Giroud Dan Lloris

May 15, 2025