Gradual Interest Rate Cuts Forecast By Bank Of England For UK

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of England Forecasts Gradual Interest Rate Cuts for UK Economy

The Bank of England (BoE) has signaled a potential shift in its monetary policy, forecasting gradual interest rate cuts in the coming months. This move comes as the UK economy shows signs of slowing down, battling persistent inflation and a weakening housing market. While not a dramatic pivot, the shift represents a significant departure from the aggressive rate hikes implemented throughout 2022 to combat soaring inflation. This cautious approach suggests a delicate balancing act for the BoE as it navigates the complexities of the current economic landscape.

A Cautious Approach to Cooling Inflation

The BoE's Monetary Policy Committee (MPC) has hinted at a more measured approach to interest rate adjustments, anticipating a gradual decline rather than a sharp reduction. This strategy reflects the ongoing uncertainty surrounding inflation and its impact on the UK economy. While inflation has begun to ease, it remains stubbornly high, exceeding the BoE's 2% target. The MPC's cautious approach aims to avoid triggering a sharp economic downturn while still bringing inflation back under control. The minutes from the latest MPC meeting emphasized the need for careful monitoring of incoming data before making any significant changes to interest rates.

Factors Influencing the Forecast

Several key factors are contributing to the BoE's forecast of gradual interest rate cuts:

- Easing Inflation: While inflation remains elevated, recent data suggests a slowing trend, offering a glimmer of hope for the BoE. This provides some room for manoeuvre in terms of interest rate adjustments.

- Weakening Housing Market: The UK housing market is showing signs of weakness, with falling prices and reduced activity. This slowdown, partly attributed to higher interest rates, necessitates a more cautious approach from the BoE to avoid further dampening the market.

- Global Economic Uncertainty: Global economic headwinds, including the ongoing war in Ukraine and energy price volatility, continue to pose challenges to the UK economy. This uncertainty makes it crucial for the BoE to proceed cautiously with any rate cuts.

- Labour Market Resilience: Despite the economic slowdown, the UK labour market remains relatively strong, with low unemployment. This resilience offers some buffer against the potential negative impacts of interest rate cuts.

What This Means for UK Consumers and Businesses

The forecast of gradual interest rate cuts offers some relief to UK consumers and businesses struggling with high borrowing costs. Lower interest rates could lead to cheaper mortgages, loans, and credit card repayments, potentially boosting consumer spending and business investment. However, the pace of these cuts will be slow and carefully monitored to avoid fueling inflation again.

Looking Ahead: Uncertainty Remains

The BoE's forecast is not without its uncertainties. The trajectory of inflation, the resilience of the labour market, and the unfolding global economic situation will all play a crucial role in shaping the future path of interest rates. The MPC has emphasized its commitment to returning inflation to its 2% target and will continue to closely monitor economic data to inform its decisions. Further rate cuts are possible, but the pace and magnitude will depend on the evolving economic conditions. Stay tuned for further updates as the situation unfolds.

Further Reading:

-

- For official statements and data releases.

-

- For in-depth analysis and commentary.

Keywords: Bank of England, interest rates, UK economy, inflation, monetary policy, interest rate cuts, housing market, economic slowdown, MPC, monetary policy committee, economic forecast, UK news, finance news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gradual Interest Rate Cuts Forecast By Bank Of England For UK. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

30 Months In Prison Then Deportation A Milwaukee Mothers Story

Mar 21, 2025

30 Months In Prison Then Deportation A Milwaukee Mothers Story

Mar 21, 2025 -

Severance Season 2 Finale Explained What It Means For The Future

Mar 21, 2025

Severance Season 2 Finale Explained What It Means For The Future

Mar 21, 2025 -

Tindakan Militer Israel Di Suriah Arab Saudi Tuntut Pbb Bertindak Cepat

Mar 21, 2025

Tindakan Militer Israel Di Suriah Arab Saudi Tuntut Pbb Bertindak Cepat

Mar 21, 2025 -

Sir Gareth Southgate Urges Focus On Positive Role Models For Boys

Mar 21, 2025

Sir Gareth Southgate Urges Focus On Positive Role Models For Boys

Mar 21, 2025 -

Pi Network Hilang Dari Bursa Binance Apa Yang Terjadi

Mar 21, 2025

Pi Network Hilang Dari Bursa Binance Apa Yang Terjadi

Mar 21, 2025

Latest Posts

-

Live Stream And Tv Broadcast Details Arango Vs Andreeva At The 2025 Internazionali Bnl D Italia

May 09, 2025

Live Stream And Tv Broadcast Details Arango Vs Andreeva At The 2025 Internazionali Bnl D Italia

May 09, 2025 -

Xatar Tot Fans Nehmen Abschied Von Dem Erfolgreichen Musiker

May 09, 2025

Xatar Tot Fans Nehmen Abschied Von Dem Erfolgreichen Musiker

May 09, 2025 -

Andreeva Dominates Arango In Rome Raducanu Moves On

May 09, 2025

Andreeva Dominates Arango In Rome Raducanu Moves On

May 09, 2025 -

Peluang Besar Persebaya Untuk Menang Atas Semen Padang

May 09, 2025

Peluang Besar Persebaya Untuk Menang Atas Semen Padang

May 09, 2025 -

Film Mosul Sinopsis Lengkap Dan Jadwal Tayang Di Bioskop Trans Tv 9 Mei 2025

May 09, 2025

Film Mosul Sinopsis Lengkap Dan Jadwal Tayang Di Bioskop Trans Tv 9 Mei 2025

May 09, 2025 -

Film Pilihan Trans Tv Jadwal Tayang Dan Sinopsis 9 Mei 2025

May 09, 2025

Film Pilihan Trans Tv Jadwal Tayang Dan Sinopsis 9 Mei 2025

May 09, 2025 -

Dua Laga Penting Dewa United Esports Tantangan Pekan Ini

May 09, 2025

Dua Laga Penting Dewa United Esports Tantangan Pekan Ini

May 09, 2025 -

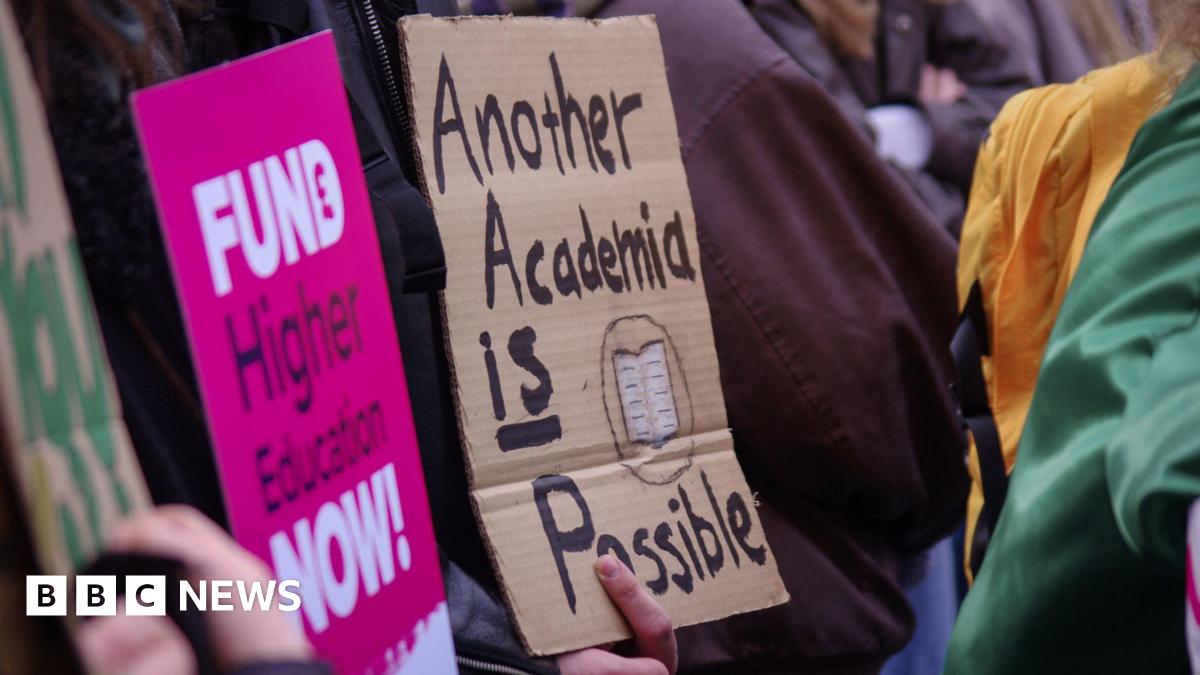

Four In Ten Universities Struggle Financially A Growing Crisis

May 09, 2025

Four In Ten Universities Struggle Financially A Growing Crisis

May 09, 2025 -

Cek Bansos Pkh 2025 Online Langkah Mudah Via Hp Dengan Nik Ktp

May 09, 2025

Cek Bansos Pkh 2025 Online Langkah Mudah Via Hp Dengan Nik Ktp

May 09, 2025 -

Perkuat Kolaborasi Pemerintah Dorong Keberhasilan Koperasi Desa Merah Putih

May 09, 2025

Perkuat Kolaborasi Pemerintah Dorong Keberhasilan Koperasi Desa Merah Putih

May 09, 2025