Gold Price Drops: Trump's Comments And China Trade Optimism Lift Dollar

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Price Drops: Trump's Comments and China Trade Optimism Lift Dollar

Gold prices tumbled on Tuesday, marking their sharpest single-day decline in months, as a confluence of factors pushed investors towards the US dollar. Positive comments from President Trump regarding the ongoing US-China trade negotiations, coupled with growing optimism about a potential trade deal, fueled a surge in the dollar's value, directly impacting gold's price. This unexpected shift leaves investors wondering about the future trajectory of precious metals.

Trump's Trade Talk Optimism Boosts Dollar: President Trump's recent pronouncements on the progress of trade talks with China injected a wave of optimism into the market. His suggestion that a "substantial phase one deal" was imminent sent ripples through financial markets, bolstering investor confidence and strengthening the dollar. This positive sentiment overshadowed concerns about global economic slowdown, a key factor that typically supports gold as a safe-haven asset. Learn more about the .

China Trade Deal Hopes Fuel Dollar Rally: The potential easing of trade tensions between the US and China significantly impacted investor sentiment. A resolution to the protracted trade dispute would likely boost global economic growth, reducing the appeal of gold as a safe haven. The anticipation of a trade deal, therefore, led to a significant flow of capital into the US dollar, further depressing gold prices. For a deeper understanding of the , visit the Council on Foreign Relations website.

H2: Understanding the Inverse Relationship Between Gold and the Dollar:

Gold is often considered an inverse proxy for the US dollar. When the dollar strengthens, as it did on Tuesday, gold becomes more expensive for holders of other currencies, reducing demand and consequently lowering its price. This inverse relationship is a fundamental principle in understanding gold's price fluctuations. This is due to gold being priced in USD, so a stronger dollar translates to a higher USD price for gold, making it less attractive to international investors.

H2: Market Reaction and Analysis:

The gold price drop was swift and significant, catching many investors off guard. Spot gold prices fell by over $20 per ounce, a considerable decline. Analysts attributed the drop primarily to the strengthening dollar and the positive sentiment surrounding the US-China trade talks. However, some analysts cautioned against reading too much into a single day's movement, suggesting that longer-term trends may still favor gold, especially given lingering global economic uncertainties.

H2: What This Means for Investors:

The recent price drop presents both challenges and opportunities for gold investors. While the short-term outlook might appear bearish, the long-term value of gold remains a subject of ongoing debate among financial experts. Investors should carefully consider their risk tolerance and investment goals before making any significant changes to their portfolios. Diversification remains a key strategy for mitigating risk within any investment portfolio.

H3: Key Takeaways:

- President Trump's positive comments on the US-China trade talks boosted the US dollar.

- The strengthening dollar caused a significant drop in gold prices.

- Optimism surrounding a potential trade deal reduced gold's safe-haven appeal.

- Investors should consider the inverse relationship between gold and the US dollar.

- Long-term investment strategies should consider broader economic factors.

Call to Action: Stay informed about the latest market trends and economic news to make well-informed investment decisions. Consider consulting with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Price Drops: Trump's Comments And China Trade Optimism Lift Dollar. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Peoples Pope Vs The Churchs Future Analyzing Key Conflicts In The Papacy

Apr 23, 2025

The Peoples Pope Vs The Churchs Future Analyzing Key Conflicts In The Papacy

Apr 23, 2025 -

Optimalkan Lari Anda Jenis Makanan Untuk Meningkatkan Stamina

Apr 23, 2025

Optimalkan Lari Anda Jenis Makanan Untuk Meningkatkan Stamina

Apr 23, 2025 -

Musim Depan Bhayangkara Fc Incar Pelatih Dari Lima Klub Teratas Liga 1

Apr 23, 2025

Musim Depan Bhayangkara Fc Incar Pelatih Dari Lima Klub Teratas Liga 1

Apr 23, 2025 -

Market Reeling Trumps Comments On Fed Chair Send Stocks And Dollar Lower

Apr 23, 2025

Market Reeling Trumps Comments On Fed Chair Send Stocks And Dollar Lower

Apr 23, 2025 -

Valencia Vs Espanyol Pertandingan Papan Tengah Siapa Yang Menang

Apr 23, 2025

Valencia Vs Espanyol Pertandingan Papan Tengah Siapa Yang Menang

Apr 23, 2025

Latest Posts

-

Russian Strike On Ukrainian Bus Leaves Nine Dead Witnesses

May 19, 2025

Russian Strike On Ukrainian Bus Leaves Nine Dead Witnesses

May 19, 2025 -

Fatal Business Park Fire Identities Of Deceased Firefighters Confirmed

May 19, 2025

Fatal Business Park Fire Identities Of Deceased Firefighters Confirmed

May 19, 2025 -

Government Announces New Eu Agreement And Reversal On Fuel Policy

May 19, 2025

Government Announces New Eu Agreement And Reversal On Fuel Policy

May 19, 2025 -

Premier League Matchday Everton Card Prediction And Betting Advice

May 19, 2025

Premier League Matchday Everton Card Prediction And Betting Advice

May 19, 2025 -

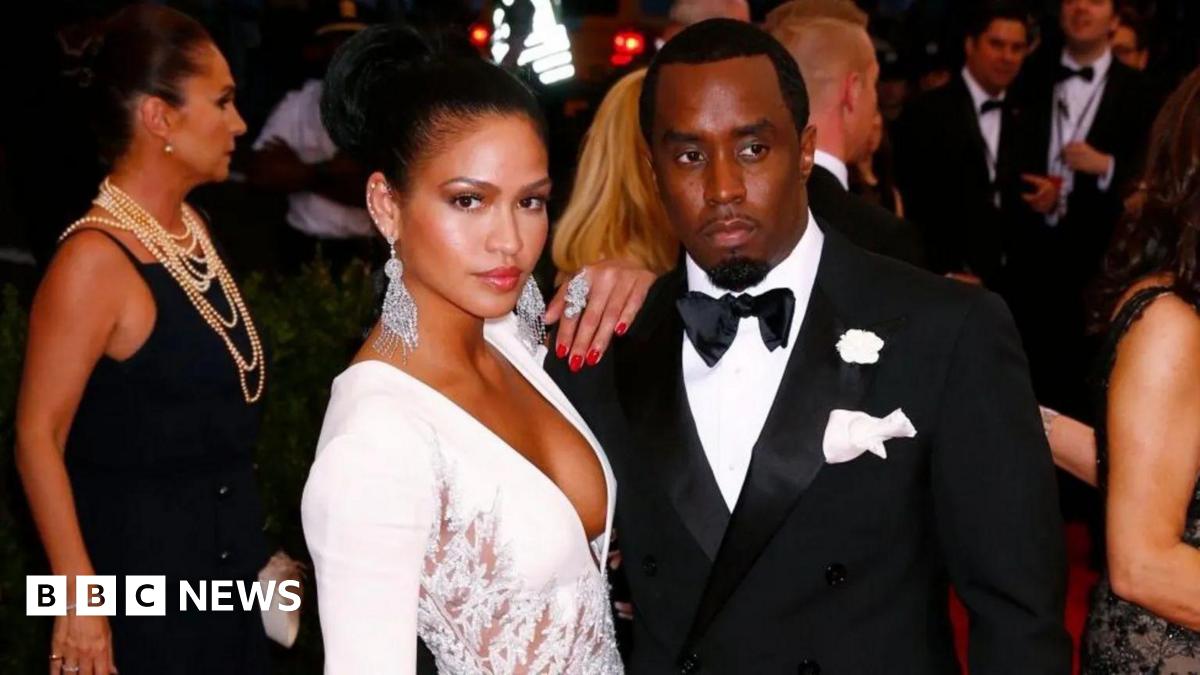

Cassie Venturas Testimony The Linchpin In Diddys Case

May 19, 2025

Cassie Venturas Testimony The Linchpin In Diddys Case

May 19, 2025 -

What Trumps Recent Diplomacy Reveals About His True Goals

May 19, 2025

What Trumps Recent Diplomacy Reveals About His True Goals

May 19, 2025 -

Motul Czech Round May 17 2025 Live Stream World Ssp Race 1

May 19, 2025

Motul Czech Round May 17 2025 Live Stream World Ssp Race 1

May 19, 2025 -

Dendam Kelam Malam Marissa Anita Dan Studi Mendalamnya Tentang Machiavellianisme

May 19, 2025

Dendam Kelam Malam Marissa Anita Dan Studi Mendalamnya Tentang Machiavellianisme

May 19, 2025 -

James Comeys Secret Service Interview Details Emerge On Trump Seashell Controversy

May 19, 2025

James Comeys Secret Service Interview Details Emerge On Trump Seashell Controversy

May 19, 2025 -

Passengers Flight Disappeared British Airways Booking Glitch Leaves Traveler Stranded

May 19, 2025

Passengers Flight Disappeared British Airways Booking Glitch Leaves Traveler Stranded

May 19, 2025