First-Time Homebuyers: Essential Tips And Strategies For Success

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Homebuyers: Essential Tips and Strategies for Success

Buying your first home is a monumental milestone, filled with excitement, but also a healthy dose of anxiety. Navigating the complex world of mortgages, inspections, and closing costs can feel overwhelming. However, with careful planning and the right strategies, your dream of homeownership can become a reality. This guide offers essential tips and strategies to help first-time homebuyers achieve success.

Understanding Your Financial Situation: The Foundation of Success

Before even browsing listings, a thorough understanding of your finances is crucial. This involves more than just checking your bank account. You need a realistic picture of your:

- Credit Score: Your credit score significantly impacts your mortgage interest rate. Aim for a score above 700 for the best rates. Check your credit report for errors and work on improving your score if needed. Websites like allow you to access your reports for free.

- Debt-to-Income Ratio (DTI): Lenders assess your DTI to determine your ability to repay a mortgage. A lower DTI increases your chances of approval and secures better loan terms. Reducing high-interest debts before applying for a mortgage is a smart move.

- Savings: You'll need funds for a down payment, closing costs, and potential unforeseen expenses. Aim to save at least 3-6% of the home's price for a down payment, but larger down payments often translate to lower mortgage rates. Explore options like that may offer assistance with down payments.

Finding the Right Mortgage: Navigating Loan Options

The mortgage process can be intricate, but understanding your options is key:

- Conventional Loans: These are offered by private lenders and typically require a larger down payment and a higher credit score.

- FHA Loans: Backed by the Federal Housing Administration, these loans often require lower down payments and credit scores, making them accessible to more first-time buyers.

- VA Loans: Available to eligible veterans and military personnel, VA loans offer competitive interest rates and often require no down payment.

- USDA Loans: These loans are designed for rural homebuyers and may offer favorable terms.

Beyond the Mortgage: Essential Steps in the Homebuying Process

Once you've secured pre-approval for a mortgage (a crucial step!), the search begins:

- Working with a Real Estate Agent: A skilled real estate agent acts as your advocate, guiding you through negotiations, inspections, and closing.

- Home Inspections: Never skip a home inspection! This crucial step identifies potential problems before you commit to the purchase.

- Negotiating the Offer: Your agent will help you craft a competitive offer, considering factors like price, contingencies, and closing dates.

- Closing Costs: Be prepared for closing costs, which can range from 2% to 5% of the loan amount. These costs include appraisal fees, title insurance, and other administrative expenses.

Tips for Success:

- Start Early: Begin saving and researching well in advance of your desired purchase date.

- Set a Realistic Budget: Don't overextend yourself financially. Consider not only the mortgage payment but also property taxes, insurance, and maintenance costs.

- Stay Organized: Keep meticulous records of all documents and communications throughout the process.

- Ask Questions: Don't hesitate to ask your real estate agent, lender, or other professionals for clarification on anything you don't understand.

Buying your first home is a significant investment and a journey filled with learning and growth. By following these tips and strategies, you can navigate the process confidently and successfully achieve the dream of homeownership. Remember to seek professional advice tailored to your specific circumstances. Good luck!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Homebuyers: Essential Tips And Strategies For Success. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What Is De Minimis A Case Study My 400 Online Shopping Experience

May 12, 2025

What Is De Minimis A Case Study My 400 Online Shopping Experience

May 12, 2025 -

Can Labours Immigration Plans Turn The Tide Ahead Of The Next Election

May 12, 2025

Can Labours Immigration Plans Turn The Tide Ahead Of The Next Election

May 12, 2025 -

Las Fallas Constructivas En Tenerife Investigacion Sobre El Proyecto Garrido

May 12, 2025

Las Fallas Constructivas En Tenerife Investigacion Sobre El Proyecto Garrido

May 12, 2025 -

Post Inter Il Napoli Deve Vincere Lobotka E Neres Tra Titolari E Panchina

May 12, 2025

Post Inter Il Napoli Deve Vincere Lobotka E Neres Tra Titolari E Panchina

May 12, 2025 -

Napoli X Dopo La Vittoria Dell Inter La Partita Chiave Per Gli Azzurri

May 12, 2025

Napoli X Dopo La Vittoria Dell Inter La Partita Chiave Per Gli Azzurri

May 12, 2025

Latest Posts

-

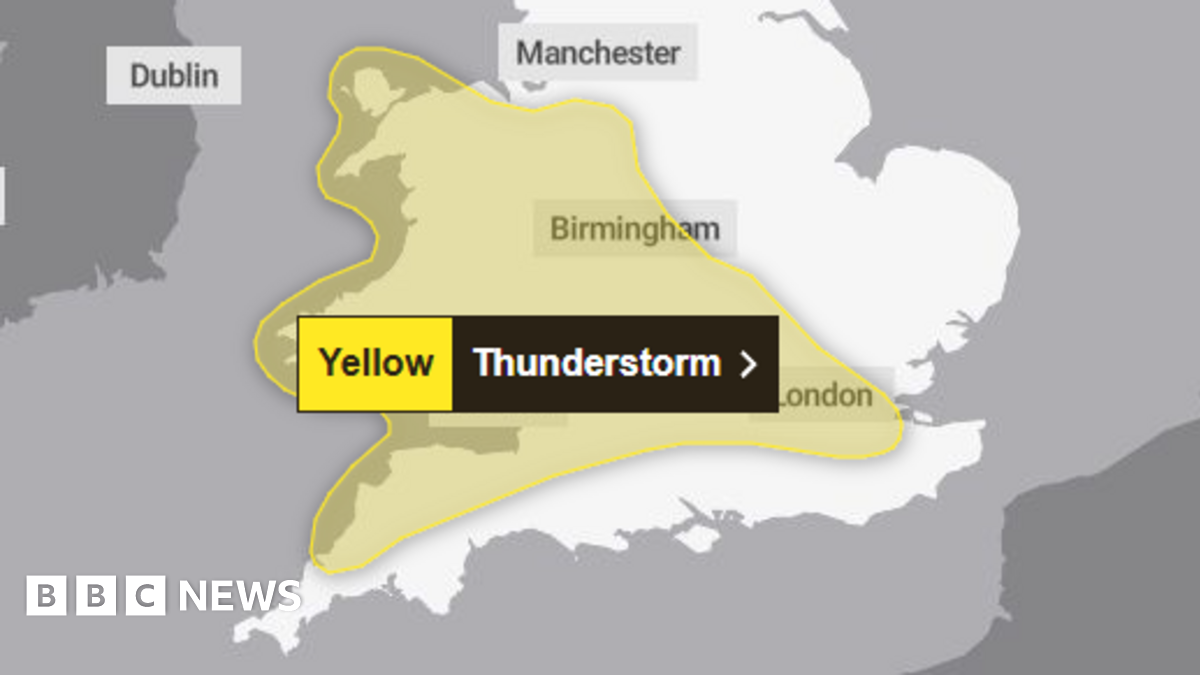

Severe Thunderstorms And Flood Warnings Issued For England And Wales

May 13, 2025

Severe Thunderstorms And Flood Warnings Issued For England And Wales

May 13, 2025 -

Tragic Update Another Teenager Fatality In Buncrana Swimming Accident

May 13, 2025

Tragic Update Another Teenager Fatality In Buncrana Swimming Accident

May 13, 2025 -

Partido El Nacional Vs Vinotinto Ecuador Como Verlo En Vivo Por Tv Y Online

May 13, 2025

Partido El Nacional Vs Vinotinto Ecuador Como Verlo En Vivo Por Tv Y Online

May 13, 2025 -

Indonesia Vs China Media Vietnam Sebut Sanksi Fifa Rugikan Timnas

May 13, 2025

Indonesia Vs China Media Vietnam Sebut Sanksi Fifa Rugikan Timnas

May 13, 2025 -

Surprise Amber Heard Reveals Shes A Mother Of Twins

May 13, 2025

Surprise Amber Heard Reveals Shes A Mother Of Twins

May 13, 2025 -

Jelang Laga Kontra China Media Vietnam Sorot Dampak Sanksi Fifa Pada Timnas Indonesia

May 13, 2025

Jelang Laga Kontra China Media Vietnam Sorot Dampak Sanksi Fifa Pada Timnas Indonesia

May 13, 2025