Financial Instability: 10% Of Britons Report Zero Savings, FSA Data Shows

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Instability Grips Britain: 10% Report Zero Savings, FSA Data Reveals

A worrying new report from the Financial Services Authority (FSA) has exposed the precarious financial situation of a significant portion of the British population. The data reveals a stark reality: a full 10% of Britons report having absolutely no savings, highlighting a growing vulnerability to unexpected financial shocks. This alarming statistic underscores the need for urgent action to address the widening wealth gap and improve financial literacy across the nation.

The FSA's findings, released earlier this week, paint a concerning picture of financial insecurity in the UK. The report, based on a comprehensive survey of over 5,000 adults, delves deep into the savings habits and financial resilience of the British population. The revelation that one in ten individuals possess zero savings represents a significant increase compared to previous years, indicating a worsening trend.

The Impact of Rising Living Costs

This alarming figure is directly linked to the relentless rise in the cost of living. Soaring inflation, energy price hikes, and increased grocery bills have left many households struggling to make ends meet, let alone put money aside for a rainy day. The squeeze on household incomes has forced many to deplete existing savings, while others have found themselves unable to save anything at all. This leaves them extremely vulnerable to unexpected events, such as job loss, illness, or home repairs.

- Increased pressure on low-income households: The data shows a disproportionate impact on low-income households, many of whom are already struggling to afford basic necessities.

- Impact on mental health: Financial instability is strongly linked to increased stress and anxiety, significantly impacting mental wellbeing.

- Growing reliance on credit: The report also highlights a growing reliance on credit cards and high-interest loans to cover essential expenses, further exacerbating the financial difficulties.

What Can Be Done?

The FSA's report calls for a multi-pronged approach to address this escalating crisis. This includes:

- Improved financial education: Teaching financial literacy from a young age is crucial to empower individuals to manage their finances effectively. Initiatives focusing on budgeting, saving, and responsible borrowing are vital. [Link to a relevant government website about financial literacy].

- Government support schemes: The government needs to consider expanding existing support schemes and introducing new initiatives to help vulnerable households cope with rising living costs. This could include targeted benefits or support for energy bills.

- Increased access to affordable credit: The availability of affordable and responsible credit options is crucial for those facing unexpected financial difficulties.

Looking Ahead: A Call for Action

The 10% figure representing Britons with zero savings serves as a stark warning. The current financial climate is leaving many vulnerable and at risk of falling into deeper financial hardship. This is not merely a statistical anomaly; it reflects a societal issue demanding immediate attention. The government, financial institutions, and individuals all have a role to play in tackling this challenge and building a more financially secure future for all Britons. We need a collective effort to address this issue before it spirals further out of control. What measures do you think are most crucial to address this growing concern? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Instability: 10% Of Britons Report Zero Savings, FSA Data Shows. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

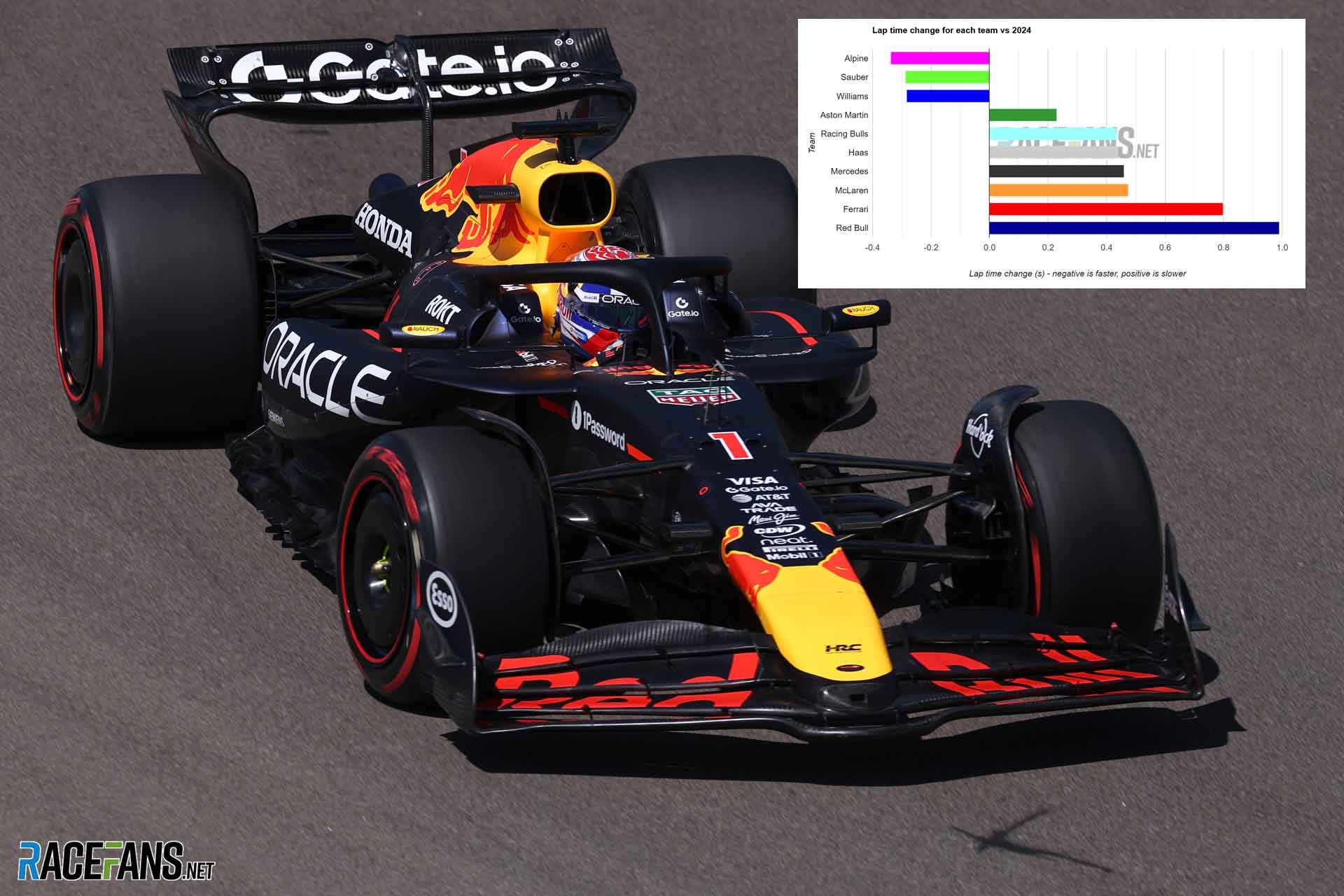

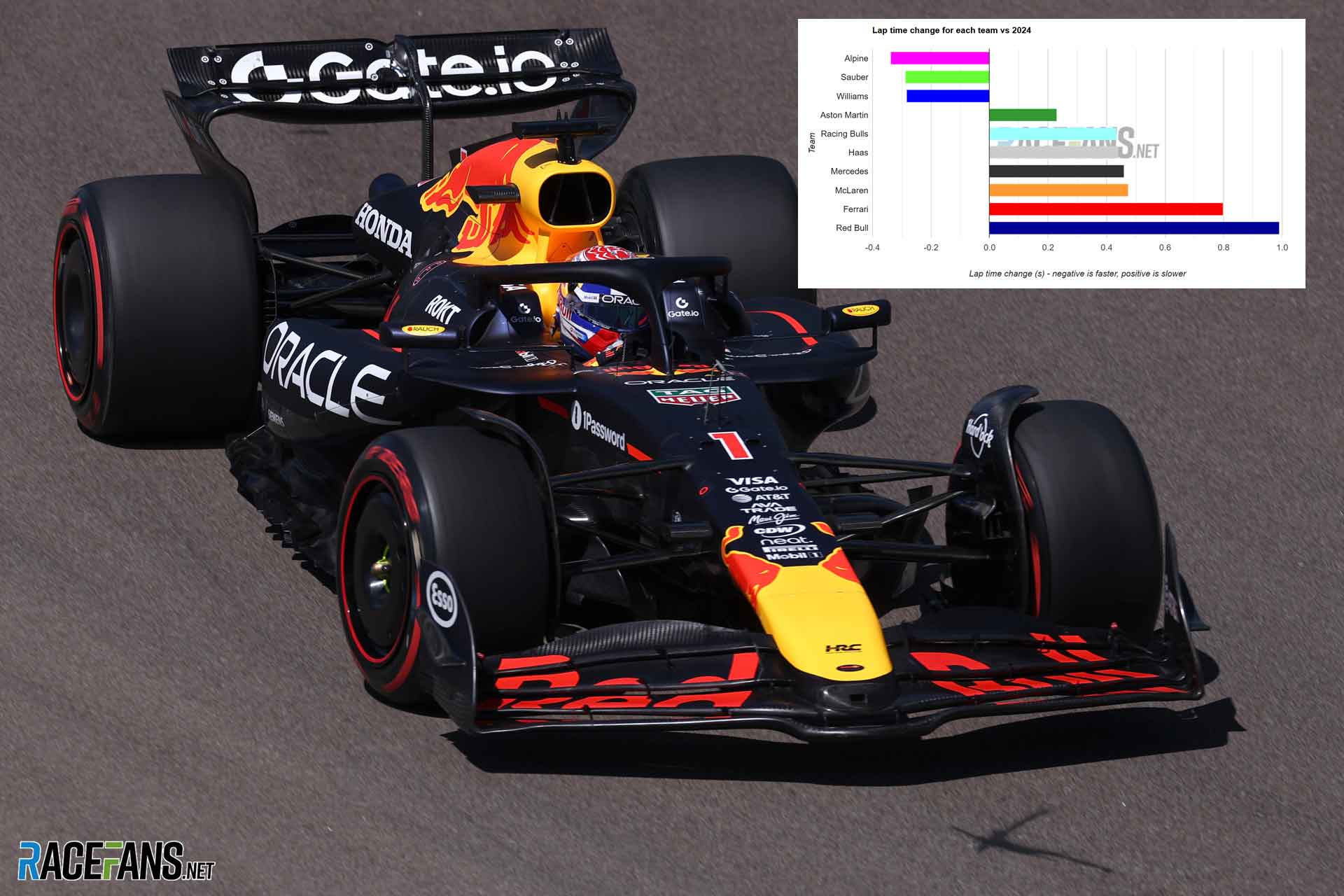

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025 -

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Terpuruk Di Dasar Klasemen

May 18, 2025

Sandy Walsh Di Yokohama F Marinos Kurang Menit Bermain Tim Terpuruk Di Dasar Klasemen

May 18, 2025 -

Resensi Film Cocote Tonggo Gosip Tetangga Dalam Balutan Komedi Segar

May 18, 2025

Resensi Film Cocote Tonggo Gosip Tetangga Dalam Balutan Komedi Segar

May 18, 2025 -

1 9 Ton Narkoba Digagalkan Tni Al Kapal Ditangkap Di Perairan Kepri

May 18, 2025

1 9 Ton Narkoba Digagalkan Tni Al Kapal Ditangkap Di Perairan Kepri

May 18, 2025 -

Can Trump And Putin Help Broker Peace In Ukraine Us Thinks So

May 18, 2025

Can Trump And Putin Help Broker Peace In Ukraine Us Thinks So

May 18, 2025

Latest Posts

-

Investigasi Hukum Dari Korupsi Rita Widyasari Hingga Konten Inses

May 18, 2025

Investigasi Hukum Dari Korupsi Rita Widyasari Hingga Konten Inses

May 18, 2025 -

Aktor Film Cocote Tonggo Jelajahi Sentra Tenun Kediri

May 18, 2025

Aktor Film Cocote Tonggo Jelajahi Sentra Tenun Kediri

May 18, 2025 -

Depok Airgun Ketua Grib Jaya Melukai Pekerja Konstruksi

May 18, 2025

Depok Airgun Ketua Grib Jaya Melukai Pekerja Konstruksi

May 18, 2025 -

Uk Financial Regulator Highlights Savings Gap One In Ten Britons With No Savings

May 18, 2025

Uk Financial Regulator Highlights Savings Gap One In Ten Britons With No Savings

May 18, 2025 -

Mps Push For Farm Inheritance Tax Delay A Year To Plan For The Future

May 18, 2025

Mps Push For Farm Inheritance Tax Delay A Year To Plan For The Future

May 18, 2025 -

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025

Imola Highlights Red Bulls 2024 Pace Deficit

May 18, 2025 -

Red Bulls Imola Performance A Significant Gap To 2024 Targets

May 18, 2025

Red Bulls Imola Performance A Significant Gap To 2024 Targets

May 18, 2025 -

Jadwal Pendaftaran Stin 2025 Kapan Dibuka Dan Persyaratannya

May 18, 2025

Jadwal Pendaftaran Stin 2025 Kapan Dibuka Dan Persyaratannya

May 18, 2025 -

Australian War Heros Defamation Appeal Fails Full Breakdown Of The Ruling

May 18, 2025

Australian War Heros Defamation Appeal Fails Full Breakdown Of The Ruling

May 18, 2025 -

London Nightclub Assault Chris Brown Faces Criminal Charges

May 18, 2025

London Nightclub Assault Chris Brown Faces Criminal Charges

May 18, 2025