Bank Of England Predicts Gradual UK Interest Rate Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of England Predicts Gradual UK Interest Rate Decline: Relief for Mortgage Holders?

The Bank of England (BoE) has forecast a gradual decline in UK interest rates, offering a glimmer of hope for homeowners and businesses burdened by soaring borrowing costs. This shift in monetary policy signals a potential easing of the current economic pressures, although experts caution against premature celebrations. The announcement, made following the latest Monetary Policy Committee (MPC) meeting, suggests a more optimistic outlook for the UK economy than previously anticipated.

A Turning Point in the UK Interest Rate Cycle?

For months, the BoE has aggressively hiked interest rates to combat persistent inflation. This strategy, while effective in curbing price increases to some extent, has also significantly impacted household finances, particularly for those with variable-rate mortgages. The predicted decline, however, suggests that the central bank believes inflation is finally coming under control and that further drastic measures are unnecessary. This represents a significant shift from the more hawkish stance adopted throughout much of 2022 and early 2023.

What Does This Mean for Mortgage Holders?

The projected rate decrease is expected to be gradual, a phased approach designed to minimize market volatility. This means that mortgage holders shouldn't expect immediate, dramatic reductions in their monthly payments. However, the news offers a degree of certainty and a potential path towards more affordable borrowing in the coming months and years. Those on variable-rate mortgages will likely see a reduction in their interest payments first, while those on fixed-rate mortgages will only benefit when their current terms expire and they remortgage at the lower rates.

- Impact on Variable Rate Mortgages: Expect a gradual decrease in monthly payments as the base rate falls.

- Impact on Fixed Rate Mortgages: No immediate impact, benefits only realized upon remortgaging.

- Impact on Businesses: Reduced borrowing costs could stimulate investment and economic growth.

Economic Factors Influencing the Decision

The BoE's decision is influenced by several key economic factors, including:

- Easing Inflation: While still above the target of 2%, inflation shows signs of slowing down. [Link to Office for National Statistics inflation data]

- Weakening Economic Growth: Concerns about a potential recession have prompted a more cautious approach to interest rate hikes.

- Global Economic Uncertainty: Geopolitical events and global economic instability continue to play a role in the BoE's decision-making.

Cautious Optimism: Challenges Remain

Despite the positive news, challenges persist. The path to economic recovery remains uncertain, and further rate cuts are not guaranteed. The BoE has stressed that the situation remains fluid and that the trajectory of interest rates will depend on future economic data. It's crucial to monitor the economic indicators closely and consult with financial advisors for personalized advice.

Looking Ahead: What to Expect

The BoE's announcement provides a much-needed dose of optimism for the UK economy. However, it's essential to approach this news with a degree of caution. The predicted gradual decline in interest rates is a positive step, but it's not a guaranteed panacea for all economic woes. Careful financial planning and monitoring of economic developments remain crucial for both individuals and businesses. For up-to-date information on UK interest rates and economic forecasts, regularly check the Bank of England's official website. [Link to Bank of England website]

Call to Action: Stay informed about economic developments and consult a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of England Predicts Gradual UK Interest Rate Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uefa World Cup Qualifiers In Depth Look At Cyprus Vs San Marino

Mar 21, 2025

Uefa World Cup Qualifiers In Depth Look At Cyprus Vs San Marino

Mar 21, 2025 -

Tanpa Aplikasi Tutorial Cepat Membuat Efek Velocity Di Tik Tok

Mar 21, 2025

Tanpa Aplikasi Tutorial Cepat Membuat Efek Velocity Di Tik Tok

Mar 21, 2025 -

Tutorial Mudah Bikin Efek Velocity Tik Tok Tanpa Software Editing

Mar 21, 2025

Tutorial Mudah Bikin Efek Velocity Tik Tok Tanpa Software Editing

Mar 21, 2025 -

Mengenal Lebih Dalam Tren Velocity Yang Sedang Viral Di Media Sosial

Mar 21, 2025

Mengenal Lebih Dalam Tren Velocity Yang Sedang Viral Di Media Sosial

Mar 21, 2025 -

Snow White Movie Praise And Criticism A Balanced Look

Mar 21, 2025

Snow White Movie Praise And Criticism A Balanced Look

Mar 21, 2025

Latest Posts

-

Niespodzianka Iga Swiatek Zagra Z Najlepsza Przyjaciolka

May 09, 2025

Niespodzianka Iga Swiatek Zagra Z Najlepsza Przyjaciolka

May 09, 2025 -

Bill Gates Sumbangkan Rp1 651 Triliun Masa Depan Anak Anaknya Terjamin

May 09, 2025

Bill Gates Sumbangkan Rp1 651 Triliun Masa Depan Anak Anaknya Terjamin

May 09, 2025 -

Rp 195 Juta Untuk Jabatan Pengakuan Kadis Kepada Rohidin Mersyah

May 09, 2025

Rp 195 Juta Untuk Jabatan Pengakuan Kadis Kepada Rohidin Mersyah

May 09, 2025 -

Kiprah Shayne Pattynama Di Kas Eupen Analisis Sebelum Transfer

May 09, 2025

Kiprah Shayne Pattynama Di Kas Eupen Analisis Sebelum Transfer

May 09, 2025 -

Kasus Suap Rp 195 Juta Untuk Pertahankan Jabatan Pengakuan Kadis

May 09, 2025

Kasus Suap Rp 195 Juta Untuk Pertahankan Jabatan Pengakuan Kadis

May 09, 2025 -

Dana Politik Rp 3 4 Miliar Kejelasan Aliran Dana Dari Rohidin Ke Kaur Dipertanyakan

May 09, 2025

Dana Politik Rp 3 4 Miliar Kejelasan Aliran Dana Dari Rohidin Ke Kaur Dipertanyakan

May 09, 2025 -

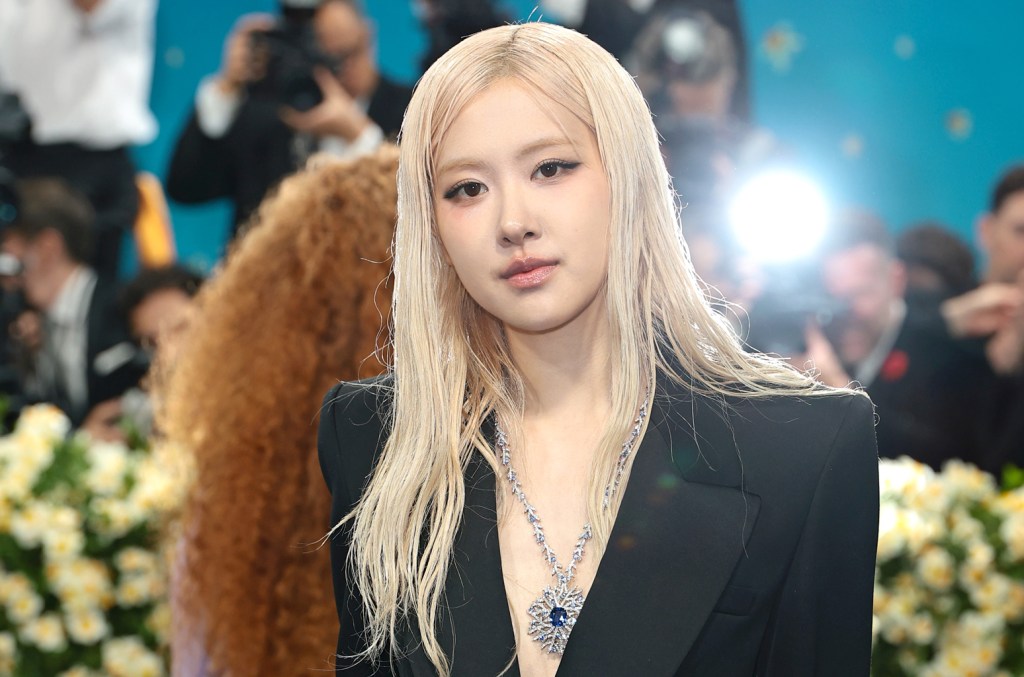

Roses Yves Saint Laurent Tuxedo A Met Gala 2025 Highlight

May 09, 2025

Roses Yves Saint Laurent Tuxedo A Met Gala 2025 Highlight

May 09, 2025 -

Forbes Umumkan Daftar 10 Orang Terkaya Asia Indonesia Absen

May 09, 2025

Forbes Umumkan Daftar 10 Orang Terkaya Asia Indonesia Absen

May 09, 2025 -

Perubahan Kepemimpinan Astra Asii Pengangkatan Rudy Sebagai Wakil Direktur Utama

May 09, 2025

Perubahan Kepemimpinan Astra Asii Pengangkatan Rudy Sebagai Wakil Direktur Utama

May 09, 2025 -

Escalating Conflict Understanding Pakistans Reaction To Indias Military Action

May 09, 2025

Escalating Conflict Understanding Pakistans Reaction To Indias Military Action

May 09, 2025