95 UK Branches To Close: Santander's Nationwide Restructuring

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Santander to Shutter 95 UK Branches: A Nationwide Restructuring Shakes Up Banking

Santander's announcement to close 95 UK branches by the end of 2023 has sent shockwaves through the British banking sector and sparked concerns for employees and customers alike. The restructuring, part of a wider move towards digital banking, will affect communities across the country and highlights the ongoing transformation of the financial landscape.

This significant downsizing represents a considerable shift in Santander's UK strategy. While the bank maintains its commitment to the UK market, this closure plan underscores the growing trend of branch closures seen across the banking industry in recent years. The move reflects the increasing preference for online and mobile banking amongst customers, a trend accelerated by the COVID-19 pandemic.

The Impact on Employees and Customers:

The closure of 95 branches will undoubtedly have a significant impact on both employees and customers. Santander has pledged to support affected employees through redeployment opportunities where possible, but job losses are inevitable. The bank has stated that it will prioritize minimizing redundancies and offering support to those affected during the transition.

For customers, the closures will mean reduced access to in-person banking services. Many rely on local branches for face-to-face assistance with complex transactions or simply prefer the personal touch of interacting with a bank representative. Santander is encouraging customers to utilize its online and mobile banking platforms, as well as its remaining branch network. However, this shift may prove challenging for some, particularly older customers or those with limited digital literacy.

The Rise of Digital Banking:

Santander's restructuring is a clear indication of the ongoing shift towards digital banking. The convenience and accessibility of online and mobile platforms are undeniable, and many banks are investing heavily in developing these technologies. This move reflects a broader trend in the financial services industry, where digital transformation is reshaping customer experiences and operational models. However, concerns remain regarding the accessibility and inclusivity of digital-only banking for all segments of the population.

What does this mean for the future of banking in the UK?

Santander’s actions reflect a larger trend within the UK banking sector. Other major banks have also announced branch closures in recent years, indicating a fundamental shift in how banking services are delivered. This raises questions about the future accessibility of banking services for vulnerable and digitally excluded communities. The government and regulatory bodies may need to consider policies to ensure financial inclusion in the face of this ongoing trend.

Key questions remain unanswered:

- Which specific branches will be closing? Santander has yet to release a full list of the affected branches, leaving many communities in uncertainty.

- What support will be offered to affected customers? Beyond encouraging digital adoption, further clarification on support for vulnerable customers is needed.

- What will be the long-term impact on employment in the UK banking sector? The ongoing trend of branch closures highlights the potential for significant job losses across the industry.

This development warrants careful observation as it unfolds. The impact of Santander’s restructuring on both the banking landscape and the communities affected will continue to be felt for some time. Staying informed about further updates and engaging in discussions about the implications of this shift is crucial. We will continue to monitor this situation and provide updates as they become available. .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 95 UK Branches To Close: Santander's Nationwide Restructuring. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kebebasan Pers Terancam Kasus Teror Kepala Babi Di Redaksi Tempo

Mar 21, 2025

Kebebasan Pers Terancam Kasus Teror Kepala Babi Di Redaksi Tempo

Mar 21, 2025 -

Israel Gempur Suriah Respon Arab Saudi Dan Tuntutan Aksi Dari Dewan Keamanan Pbb

Mar 21, 2025

Israel Gempur Suriah Respon Arab Saudi Dan Tuntutan Aksi Dari Dewan Keamanan Pbb

Mar 21, 2025 -

Power Of Attorney Misuse Were Brothers Unduly Influenced

Mar 21, 2025

Power Of Attorney Misuse Were Brothers Unduly Influenced

Mar 21, 2025 -

Gempuran Ganda Israel Dampak Serangan Di Gaza Dan Suriah

Mar 21, 2025

Gempuran Ganda Israel Dampak Serangan Di Gaza Dan Suriah

Mar 21, 2025 -

Analisa Pertandingan Ukraina Vs Belgia Di Uefa Nations League 2024 25

Mar 21, 2025

Analisa Pertandingan Ukraina Vs Belgia Di Uefa Nations League 2024 25

Mar 21, 2025

Latest Posts

-

Menko Zulhas Dorong Kopdes Untuk Tekan Tengkulak Dan Rentenir

May 10, 2025

Menko Zulhas Dorong Kopdes Untuk Tekan Tengkulak Dan Rentenir

May 10, 2025 -

How To Watch Polesie Vs Dynamo Kyiv Online Upl 2024 25 Broadcast

May 10, 2025

How To Watch Polesie Vs Dynamo Kyiv Online Upl 2024 25 Broadcast

May 10, 2025 -

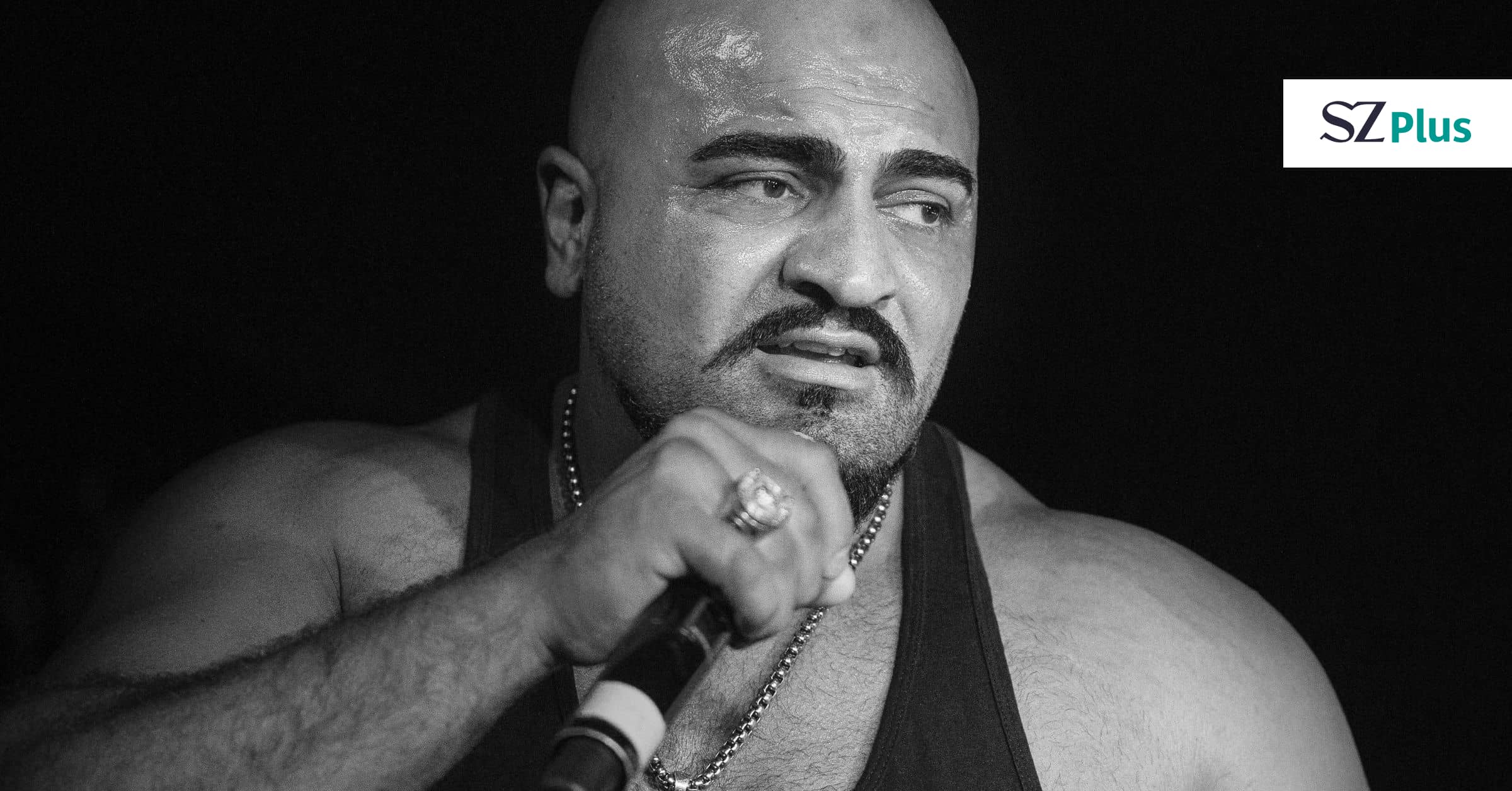

Rapper Xatar Tod Bestuerzung In Der Hip Hop Szene

May 10, 2025

Rapper Xatar Tod Bestuerzung In Der Hip Hop Szene

May 10, 2025 -

Sinopsis Film Arsenal Perjuangan Kakak Beradik Hadapi Mafia

May 10, 2025

Sinopsis Film Arsenal Perjuangan Kakak Beradik Hadapi Mafia

May 10, 2025 -

Zamaleks New Manager Under Pressure The Clock Is Ticking

May 10, 2025

Zamaleks New Manager Under Pressure The Clock Is Ticking

May 10, 2025 -

Meningkatkan Efektivitas Koperasi Desa Merah Putih Melalui Kolaborasi Yang Kuat

May 10, 2025

Meningkatkan Efektivitas Koperasi Desa Merah Putih Melalui Kolaborasi Yang Kuat

May 10, 2025 -

Video Menko Zulhas Ungkap Peran Kopdes Dalam Membasmi Tengkulak

May 10, 2025

Video Menko Zulhas Ungkap Peran Kopdes Dalam Membasmi Tengkulak

May 10, 2025 -

Official Match Commentators Revealed For Polissya Dynamo May 9 2025

May 10, 2025

Official Match Commentators Revealed For Polissya Dynamo May 9 2025

May 10, 2025 -

Der Tod Von Xatar Reaktionen Auf Den Verlust Von Goldjunge

May 10, 2025

Der Tod Von Xatar Reaktionen Auf Den Verlust Von Goldjunge

May 10, 2025 -

Brad Arnolds Cancer Battle 3 Doors Down Singer Reveals Stage Four Kidney Cancer Diagnosis

May 10, 2025

Brad Arnolds Cancer Battle 3 Doors Down Singer Reveals Stage Four Kidney Cancer Diagnosis

May 10, 2025